Although liabilities and equity are both shown on the right side of the balance sheet, there are significant differences between these building blocks of accounting that all beginners must know to differentiate between them.

Difference between Liabilities and Equity

Liabilities are the financial obligations (debt) that a business owes to anyone besides the owners, such as suppliers, lenders, and tax authorities. In comparison, equity is what’s left in a business for its owners after subtracting all external liabilities from the total assets.

What Exactly are Liabilities?

Liabilities are the financial obligations of a business to deliver something of value (e.g., cash) to others in the future. These include, for example:

- Loans borrowed from banks;

- Goods purchased on credit;

- Unpaid salaries owed to employees;

- Taxes payable to the IRS; and

- Advances received from customers.

What Exactly is Equity?

Equity, also known as owner’s equity, is the difference between the total assets and total liabilities of a business. For example, if a business has total assets worth $100,000 and total liabilities of $30,000, the owner’s equity in the business is equal to $70,000 ($100,000 – $30,000).

Owner’s equity in a business results from the owners’ capital contributions and retained profits that accumulate over the years.

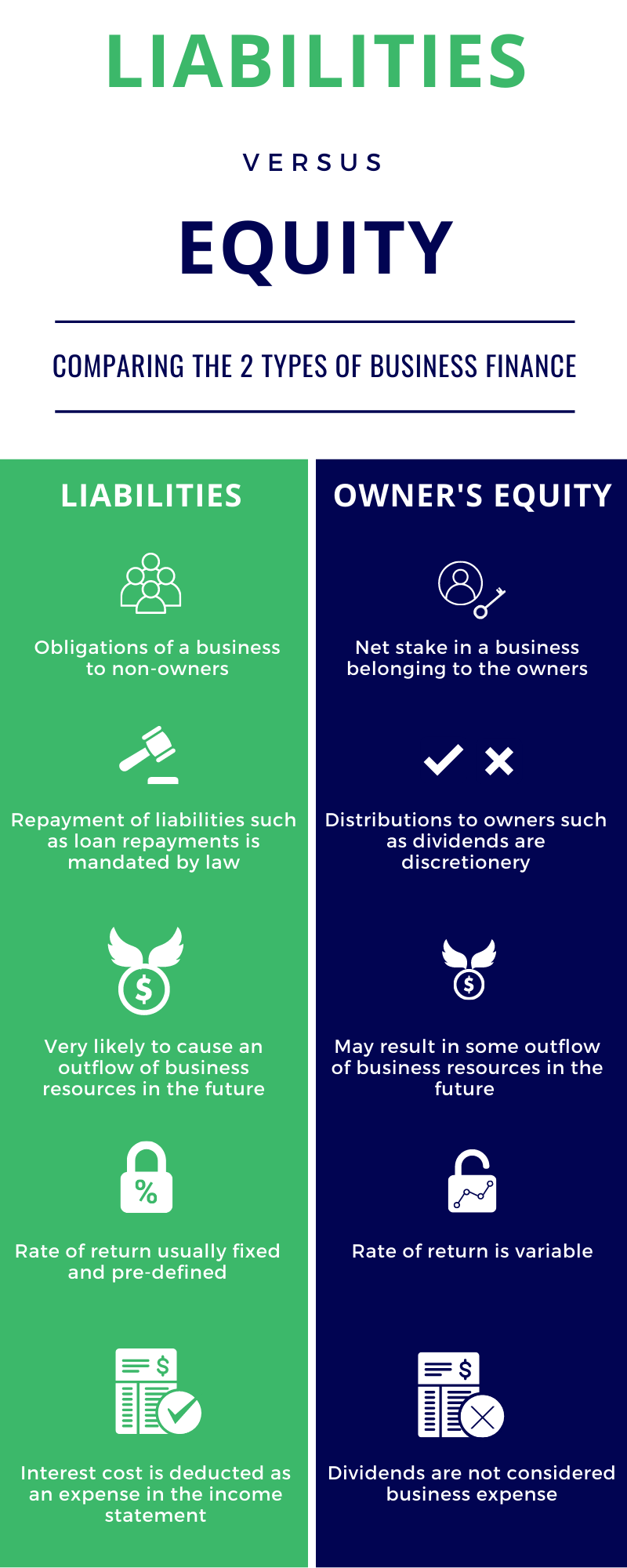

Liabilities Vs. Equity

The main difference between the two is that the repayment of liabilities is required by law, unlike the repayment of equity which is discretionary. Also, in case of bankruptcy, all liabilities of a business need to be repaid before any amount is returned to the owners.

The reason businesses often use debt is that it is generally cheaper than raising equity because:

- It has a lower risk to lenders compared to equity.

- Interest payments are usually tax-deductible, unlike payments to equity holders.

From an accounting perspective, liabilities and equity balances are both shown on the credit side of the balance sheet. However, the cost of liabilities (e.g., interest expense on borrowing) is deducted in the income statement as a financing cost. In contrast, distributions to owners (e.g., dividends) are not treated as an expense and subtracted directly from equity.

Another distinguishing feature between liabilities and equity is that the return on equity (e.g., dividends and capital gains) is primarily based on the business performance. In comparison, the interest rate of liabilities is usually a fixed and pre-defined percentage that does not vary with the future business performance.

The following infographic shows how liabilities differ from the owner’s equity.

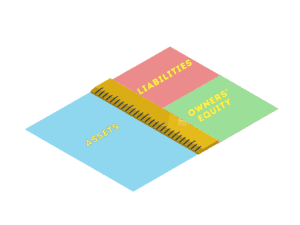

Relationship between Liabilities and Equity

Assets of a business, such as cash, inventory, machinery, and buildings, are financed by the owner’s equity and liabilities. The total assets in a business are therefore always equal to the sum of liabilities and equity.

The following accounting equation links liabilities and equity.

By re-arrange this equation, we can see that the owner’s equity is the difference between the total assets and total liabilities of a business:

By re-arrange this equation, we can see that the owner’s equity is the difference between the total assets and total liabilities of a business:

Owner’s Equity = Total Assets – Total Liabilities.

To put this in perspective, say two businesses, A and B, have the same level of assets, but A has higher liabilities than B. We expect the amount of owner’s equity in A to be lower than B because a greater share of A’s assets is financed from debt (liabilities) instead of owner contributions and retained profits (equity).

Quiz

How much do you know about Liabilities & Equity?

Question 1

In accounting, equity is the difference between the worth of __________ in a business and its liabilities.

Real Estate

Incorrect.

Assets

Spot on!

Assets include any real estate owned or controlled by the business but also include other resources such as cash, inventory, and receivables that increase the worth of a business.

Question 2

If a business has assets valued at $100,000 and the owner’s equity is worth $40,000, what are its total liabilities valued at?

$60,000

You're right!

We can re-arrange the accounting equation to calculate the value of liabilities:

Liabilities = Assets - Equity

$100,000 - $40,000 = $60,000

$140,000

Wrong answer.

Question 3

Interest expense relating to business liabilities is recorded as an expense in the income statement, but dividend payments issued to owners out of their share of equity is not classified as a business expense.

True

Correct!

False

Incorrect.

Question 4

Which of the following transactions is considered as the owner’s equity?

A) A business partner provides a loan to his partnership firm.

B) The owner pays for business expenditures by using his personal savings account.

C) A company issues redeemable preferred shares that pay a fixed dividend that is cumulative in case of non-payment.

A

Not correct.

A loan from a business partner will be treated as a liability of the business.

B

Correct!

This transaction will increase the owner's equity because the owner has provided fresh capital to the business.

C

Incorrect.

Cumulative preferred shares are treated as a liability of the company because the payment of its dividends is not discretionary.

How many questions did you answer correctly?

Score Grade

4 Master

3 Pass