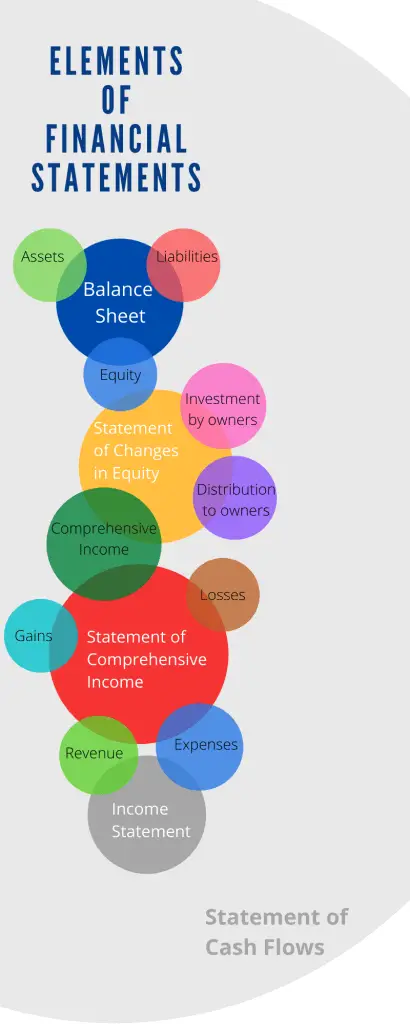

The accounting information of a business can be organized into ten elements of the financial statements.

In this lesson, I will explain what those elements are, how they interact with each other, and where each element fits in the financial statements.

Financial statements consist of ten elements that show the amounts, claims, and changes to an organization’s resources.

The ten elements of financial statements are:

- Assets

- Liabilities

- Equity

- Revenues

- Expenses

- Gains

- Losses

- Comprehensive income

- Investment by owners

- Distributions to owners

Assets

Assets are the resources that are owned or controlled by the business to receive something of value in the future.

Assets include physical properties such as machinery and buildings as well as monetary possessions such as cash and receivables.

Cash is the most liquid form of assets. Businesses require cash to exchange assets, settle liabilities, and pay for expenses and dividends in the future.

Other types of assets help businesses to generate cash inflows or minimize cash outflows in the future. For example, an investment property can generate rental income and sale proceeds in the future. A surveillance system at a warehouse can help a business in minimizing losses from theft in the future. Both are assets of the business because each provides something of value to the business in the future.

Assets also include prepayments and advances that entitle a business to receive a service or product in the future. For example, if a business pays an agency in advance for creating an ad for its upcoming marketing campaign, it is considered an asset of the business as it will entitle it to receive the advert in the future.

Liabilities

Liabilities are the business’s obligations to deliver something of value to other people and organizations besides its owners.

A simple example of a liability is a bank loan that obligates a business to pay interest and the principal amount of the borrowed loan. Another example of a liability is trade payables that arise when a business buys a product or service from a supplier on credit.

Liabilities also include revenue received in advance because it obligates a business to deliver a service or product to its customer in the future. For example, if a video game publisher receives revenue from pre-order sales, the receipts are considered as a liability of the business until the video game is shipped.

Equity

Equity is the amount of assets remaining in the business after subtracting its liabilities. It represents the part of the business belonging to its owners.

For example, if a business has assets worth $100,000, and liabilities of $60,000, the amount of equity belonging to the owners equals $40,000 (100,000 – 60,000).

Owners’ equity in business increases by:

- Investment by owners.

- Revenues.

- Gains.

- Distributions to owners.

- Expenses.

- Losses.

Revenues

Revenue is the increase in net assets arising from the principal activities of the business.

For example, revenue for a florist is the sale proceeds from selling flowers. For a bank, revenue is the interest income that it earns by lending money to its clients. Revenue for a travel agency is the commission it makes from booking flights and tours.

Revenue has the effect of increasing the amount of profit and net assets of the business.

Expenses

Expenses are the cost of assets consumed in running the primary operations of a business.

There are different types of expenses, such as salaries of employees, cost of electricity used in a factory, the cost of promoting a product, depreciation expense of a machine, and so on.

Expenses reduce the net income and equity because they cause an immediate or expected outflow of assets from the business.

Gains and Losses

Gains and losses are the changes in net assets (equity) resulting from peripheral or incidental transactions except those relating to the owners of a business.

Like revenue and expenses, gains and losses are part of the comprehensive income. However, they are presented separately to indicate that they are not part of the business’s principal activities.

Examples of transactions and events that can give rise to gains and losses include:

- Gain or loss on the disposal of a fixed asset.

- Damages, fines, and penalties arising from a lawsuit.

- Loss from natural disasters.

The distinction between revenue, gains, expenses, and losses varies according to the nature of business.

For example, profit from the sale of a building owned by a restaurant will be considered as a gain. However, the same will be treated as revenue if the seller is an investment firm operating in the real estate sector.

Comprehensive Income

Comprehensive income is the total change in equity during an accounting period from all sources, excluding any owners’ investments and distributions. It basically includes all revenues, gains, expenses, and losses during a period.

The primary measure of the profitability of an enterprise is net income, which is calculated as the difference between revenues and expenses. Net income shows how much a business has earned in a period from its major ongoing operations.

Comprehensive income is the combination of the net income and other comprehensive income that includes gains and losses from peripheral and incidental activities that a business infrequently engages in from time to time.

Examples of transactions and events that are presented in other comprehensive income include gains and losses arising from:

- Foreign currency translations.

- Derivative instruments.

- Retirement benefit plans.

Investment by Owners

Investment by owners is the increase in net assets (equity) caused by the transfer of something valuable from owners to a business in exchange for an ownership interest.

Most investments by owners involve the transfer of cash or other assets to the business in exchange for a share of ownership. However, there are several types of transactions that are classified as an investment by owners.

Examples of owner investments include:

- Cash invested by partners in a partnership firm.

- Subscription of the shares of a company by its shareholders.

- Issuing shares of a company to its employees in compensation for their services.

- Conversion of convertible bonds into share capital.

Distribution to Owners

Distribution to owners is any decrease in the ownership interest caused by the transfer of something valuable from the business to its owners, such as assets, services, or the undertaking of liabilities.

The most common example of distributions to owners is the payment of dividends to shareholders. Other examples of owner distributions include:

- Repurchase of issued share capital from shareholders by the issuing company.

- Conversion of ordinary shares into redeemable shares (debt).

Owners often sell their ownership interest in a business to another person. A transaction between owners themselves is not a distribution to owners because it does not involve any outflow of resources from the business entity itself.

Share this Page

About the Author

Related Posts