Assets = Liabilities + Equity

Accounting Equation is the key to understanding the double-entry system of accounting.

One thing that confuses many beginners is why both sides of the equation must always be equal even after so many transactions. The answer to this question is not really difficult once we understand that what a business owns is directly linked to what the business owes to owners and creditors.

A business owns nothing from the start. The left side of the Accounting Equation (assets) is always equal to its right side (liabilities + equity) because every asset that a business owns has been acquired solely from the funds that are supplied by its owners and creditors.

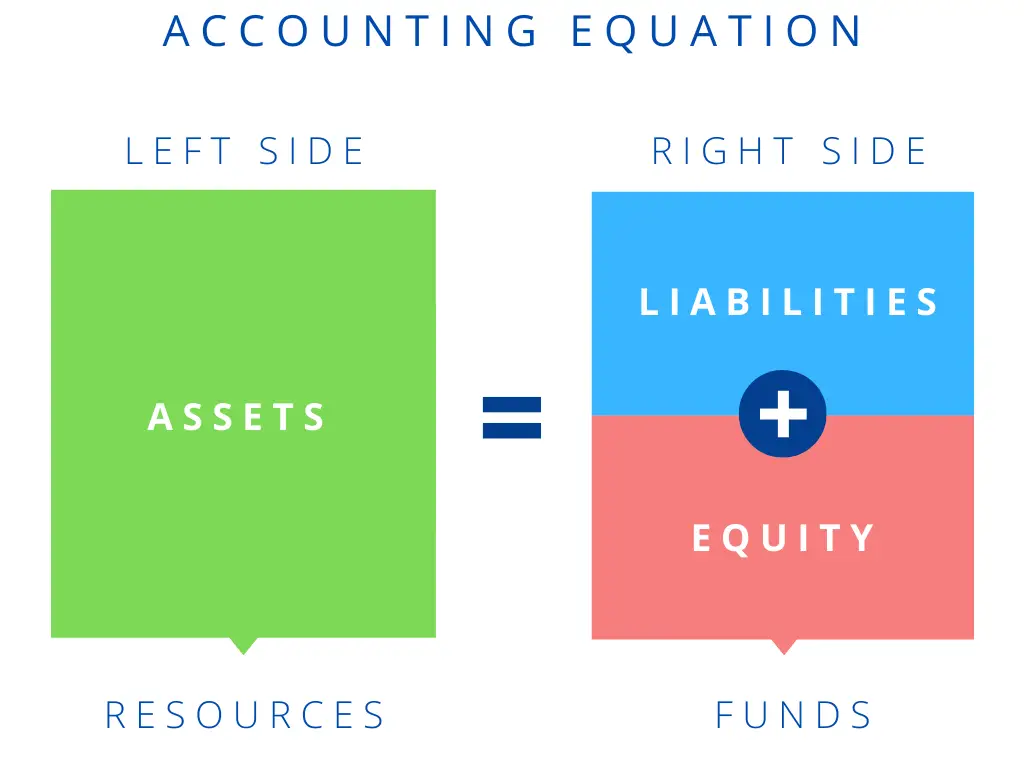

Left side Vs Right Side

Assets of business appear on the left side of the accounting equation. These are the resources owned by a business such as cash, inventory, and machinery. A business acquires its assets from the funds provided by owners and creditors.

The right side of the accounting equation shows who paid for the assets of a business. Loans from creditors appear as liabilities of the business, whereas finance provided by the owners are shown as equity. Equity and liability collectively represent the total funds that a business has obtained from and owes to its providers of finance.

Although the amount of assets, liabilities, and equity can change as a result of transactions, the totals of both sides of the accounting equation always match.

This is because any transaction that increases or decreases the assets of the business (left side) will change the amount of funds available to business (right side) by the same amount.

An Analogy

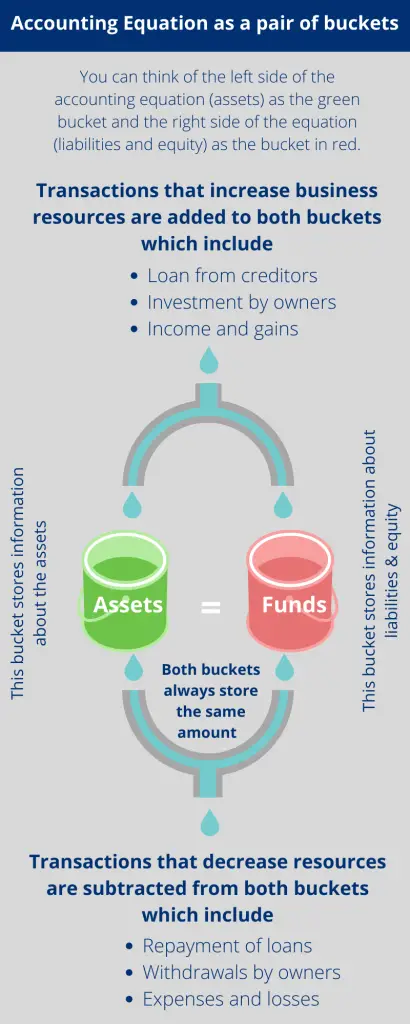

To understand this, we can think of the accounting equation as a pair of buckets that store information about the assets and funds of the business.

Transactions that increase the resources of a business are added to both buckets, while transactions that decrease resources are subtracted similarly.

Because the same amount is added and subtracted from both buckets, the accounting equation always remains in balance.

Transactions that don't affect the equation

Transactions that replace one asset, liability, or equity for another do not cause any change in the resources available to a business, which is why they don’t affect the accounting equation.

An example of this would be the purchase of a machine with cash. The transaction will cause an increase in one asset (machinery) and a decrease in another asset (cash), leaving the total amount of assets and the accounting equation unchanged.

Quiz

How much do you know about the Accounting equation balance?

Instructions for solving quiz:

- Click on one of the given options that you think is correct.

- If you are not sure about a question, review the lesson above.

- Mark yourself out of 7 by rewarding 1 mark for each correct answer.

Good luck!

Question 1

Assets = Liabilities _______ Equity

Minus

Wrong answer.

Assets are equal to the sum of liabilities and equity.

Plus

Correct!

Question 2

The accounting equation should balance if the accounting entries are correctly recorded.

True

Correct!

The left and right sides of the accounting equation match as long as the debit entries equal the credit entries.

False

Wrong answer.

Question 3

The accounting equation will not balance if a double entry is completely omitted from the accounting books.

True

Incorrect.

False

Correct!

Omissions only cause accounting equation to unbalance if only one side of an accounting entry is excluded from the record.

Question 4

Some transactions do not affect the accounting equation at all.

True

You're right!

When the double entry only affects one side of an accounting equation, the accounting equation remains the same. An example of this scenario is the replacement of one asset for another asset.

True

Incorrect.

Question 5

If one effect of an accounting entry is to decrease assets, which of the following can increase as a result?

Assets

Correct!

When one asset replaces another asset, one asset increases while the other asset decreases in the accounting books. For example, if a debtor pays back the amount owing to a business, the accounting effect is to increase the cash account and decrease the receivable account.

Liability

Wrong answer.

When the liabilities of a business increase, it results in the inflow of assets. This is why a decrease in assets cannot be associated with an increase in liabilities in accounting.

Equity

Incorrect.

Assets of a business cannot decrease when there is an increase in equity.

Question 6

A business repays its liability for a bank loan but only records the debit side of the transaction.

What should be done to balance the accounting equation?

Increase Assets

Incorrect.

Repaying a bank loan involves the outflow of business resources.

Decrease Assets

Correct!

As the debit side of the transaction is already accounted for, we only need to record the credit side. The credit entry will be made to the bank account which has the effect of decreasing the assets.

Increase Liabilities

Incorrect.

Paying off a bank loan has the effect of decreasing liabilities.

Decrease Liabilities

Wrong answer.

The repayment of a loan decreases the liabilities of the business but this aspect of the transaction has already been accounted for.

Question 7

If an income account is mistakenly debited by $50 instead of being credited, what should be done to balance the accounting equation?

Increase Assets

by $50

Incorrect.

Decrease Assets

by $50

Wrong answer.

Increase Assets

by $100

Incorrect.

Decrease Assets

by $100

Wrong answer.

Increase Equity

by $50

Incorrect.

Decrease Equity

by $50

Wrong answer.

Increase Equity

by $100

You're right!

To balance the accounting equation, we need to credit the income account twice. First, to reverse the effect of the wrong entry, and second, to record the correct entry. The debit side of the transaction is already accounted for correctly so the amount of assets don't need to change.

Decrease Equity

by $100

Incorrect.

How many questions did you answer correctly?

Score Grade

7 Master

6 Pro

4+ Pass

Share this Page

About the Author

Related Posts