For anyone new to accounting, assets and equity can seem like one and the same thing. Differentiating between these accounting elements isn’t all that difficult once you figure out how they fit together in the overall accounting equation.

Assets Vs. Equity

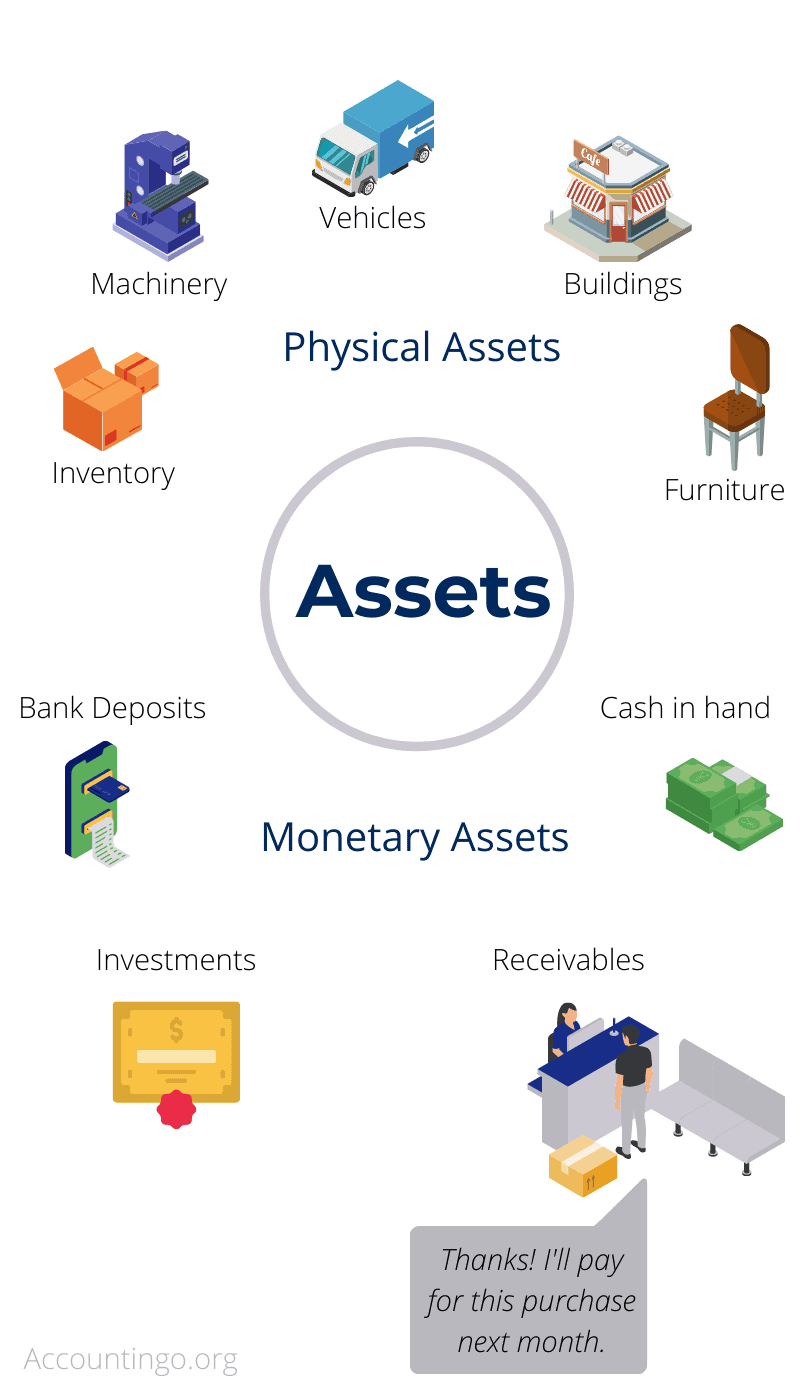

Assets are the physical and monetary properties that belong to a business, such as inventory, cash, and receivables. Equity is the business owners’ share in those assets. The difference between the total assets and total equity of a business is always equal to its total liabilities.

What exactly are Assets?

In accounting, all resources that are available to a business in the form of cash, receivables, inventory, buildings, and any other properties that can be used in the future to derive economic benefits for the business are known as assets.

Assets can be physical possessions like inventory and buildings, or they can be monetary resources such as cash and accounts receivables.

What exactly is Equity?

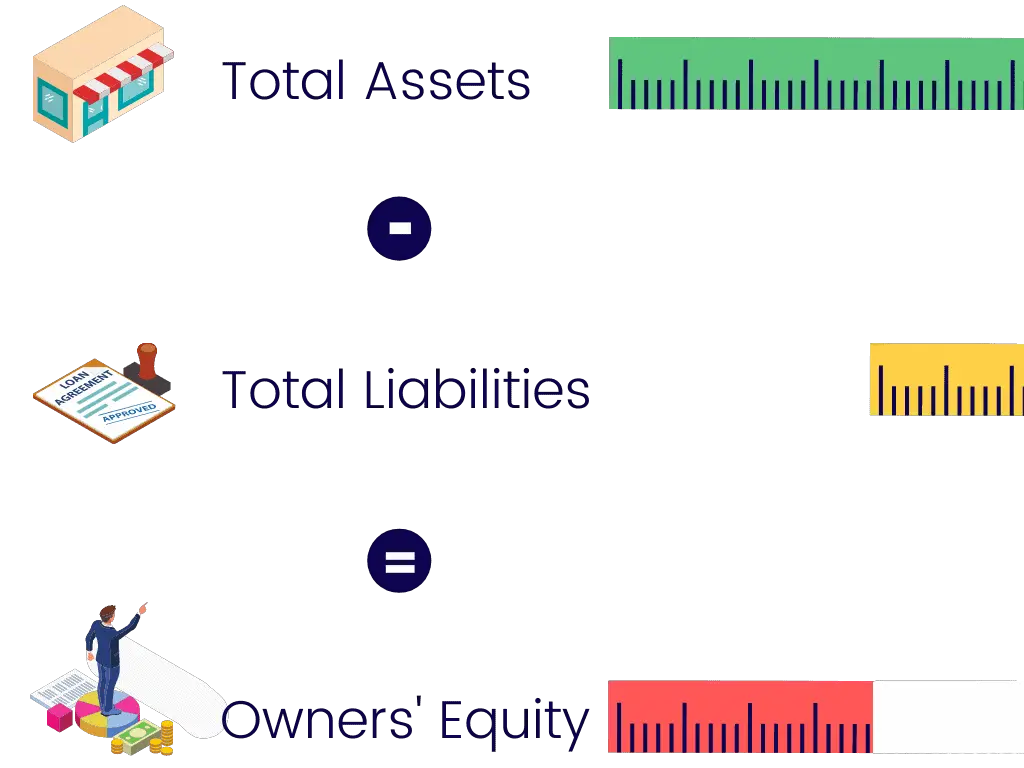

Equity is the amount of assets left in the business for its owners after deducting all the liabilities such as bank loans and trade payables.

So even though the owners’ equity depends directly on the worth of assets in a business, equity and assets are not the same things.

You can think of equity as what the owners take home if the business is shut down today after paying any amounts owed to creditors because, by law, they happen to have the first right to payment in such an event.

For example, if a business has total assets worth $50,000 and total liabilities of $20,000, we can say that the owner’s equity in that business is equal to $30,000 ($50,000 minus $20,000).

The amount of equity can increase by the owners’ contribution of capital to the business (e.g., subscription of company shares) and by the re-investment of gains and profits.

Likewise, any distribution of profits to the owners (e.g., dividends) decreases the owners’ equity in a business, as do any losses.

Because the creditors get a pre-determined amount back on their loan to the business irrespective of its profitability, any upside or downside earned on the business assets directly affects the amount of owners equity.

How are Assets And Equity Related?

Naturally, all assets that a business owns exist because someone has paid for them in the form of equity contributions or loans.

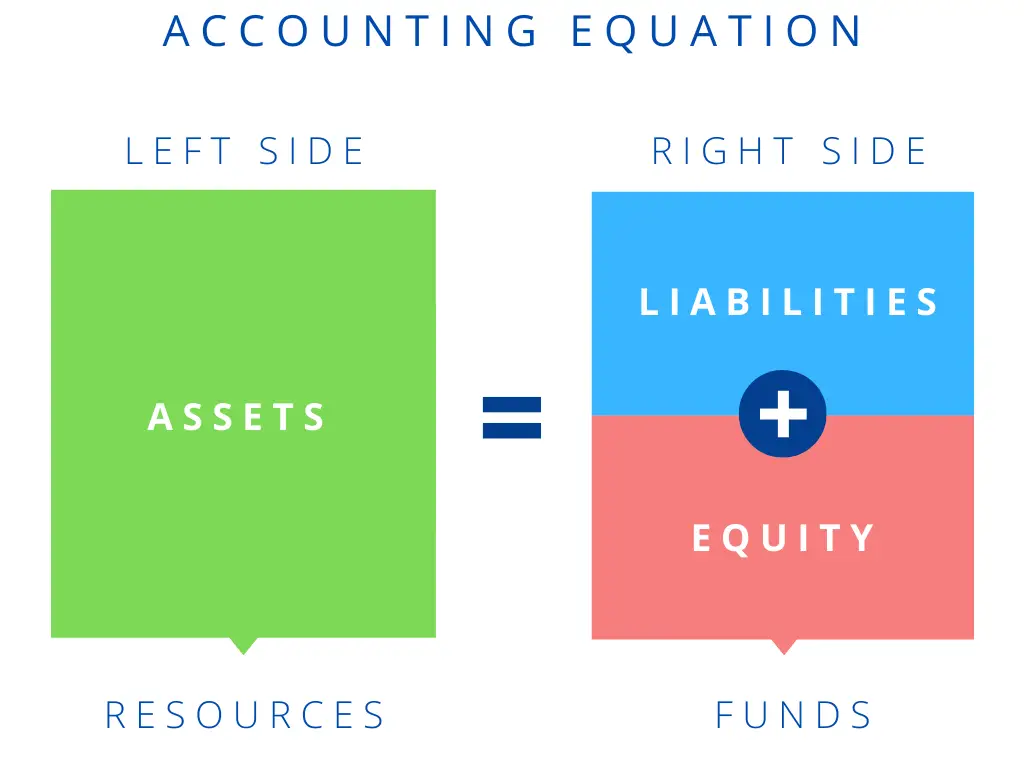

In accounting, all possessions of a business (assets) are shown on the balance sheet’s left side, whereas all claims on those resources (liabilities and equity) are shown on the right.

Assets and equity are linked together by the accounting equation: Assets = Liabilities + Equity.

How Do Assets Change Equity?

Changes in the owners’ equity often go hand in hand with changes in assets.

- Capital contribution by business partners increases the cash at bank (asset) and owners’ capital (equity).

- Profits earned by the business increase assets such as cash, receivables, and inventory and cause an equal increase in retained earnings (equity).

- Dividends to owners decrease the cash at bank account (asset) and retained earnings (equity).

Question 1

_________________ is the owners’ stake in a business.

Asset

Incorrect.

Equity

Spot on!

Question 2

Assets and equity can never be equal in a business.

True

Wrong answer.

False

You're right!

Even though assets and equity mean different things, their value can equal when a business has zero liabilities.

Question 3

What is the difference between assets and equity called?

Retained

Earnings

Not correct.

Liabilities

Correct!

Assets minus equity is equal to liabilities.

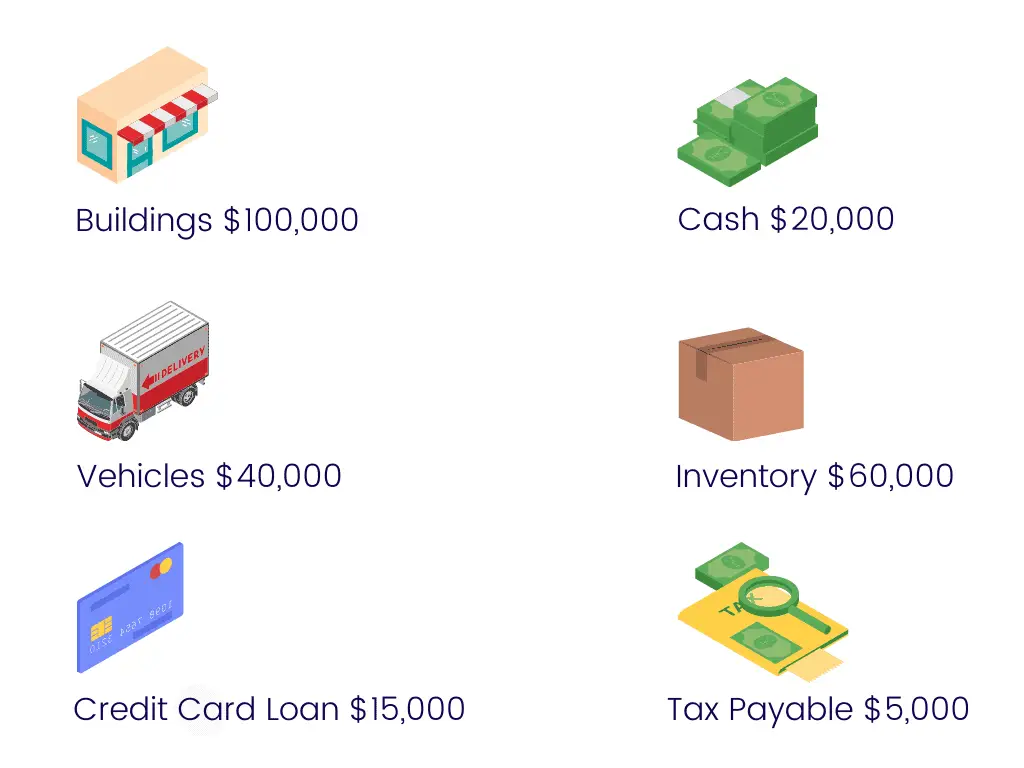

Question 4

a) What is the total amount of assets?

$240,000

Not correct.

$220,000

You're right!

$100k + $20k + $40k + $60k = $220k.

b) What is the value of equity?

$220,000

Not correct.

$200,000

Correct!

Equity is calculated by subtracting liabilities from the value of total assets.

$220k - $15k - $5k = $200k.

How many questions did you answer correctly?

Score Grade

5 Master

4 Pass