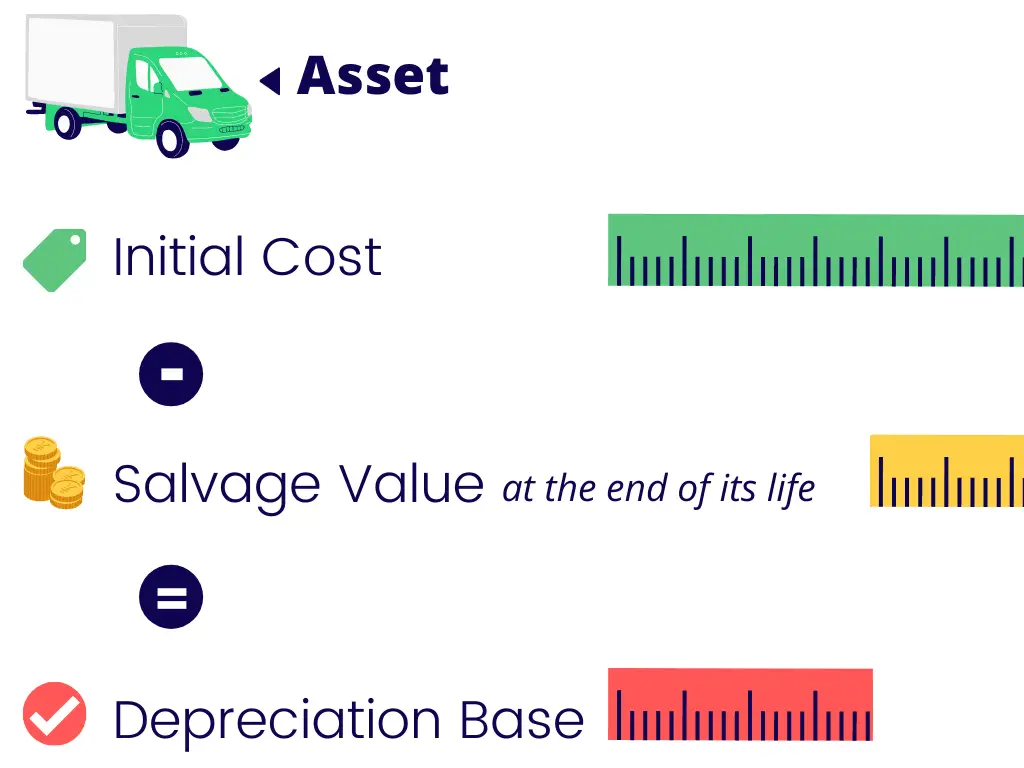

Before we can calculate the depreciation expense of an asset, we need to know how much of its original cost will be charged as depreciation over its entire life, i.e., its depreciation base.

In this article, I explain what is meant by depreciation base, how you can calculate it, and some accounting rules you need to remember when doing so.

Depreciation Base

The depreciation base of a fixed asset is its initial cost minus any salvage value at the end of its useful life. For example, a car with an initial cost of $20,000 and a scrap value of $5,000 at the end of its useful life will have a depreciation base equal to $15,000 ($20,000 – $5000).

An asset’s depreciation base is the value that will be charged over its useful life as a depreciation expense using a suitable method such as the straight-line method or sum of the years’ digits method.

We need to calculate the depreciation base of assets because we do not want to depreciate the part of the asset’s cost that can be ‘salvaged’ at the end of its useful life.

To find the depreciation base, we need to add all capital expenditures that make up an asset’s initial cost and subtract any salvage value.

Formula

Initial Cost of Assets

The initial or original cost of fixed assets is primarily their purchase cost and includes any capital expenditure necessary to get the asset ready for business use, such as transportation cost, installation fee, cost of initial repairs, and legal charges. These are the costs that are capitalized in the balance sheet as fixed assets.

However, not all costs relating to fixed assets are included in the initial cost and capitalized as assets.

Revenue expenditures are not part of the initial cost of fixed assets. Examples of such costs are minor repairs and maintenance expenses that do not enhance the usability of assets in any meaningful way but merely preserve the fixed asset’s functionality.

Example 1

Bill purchased a car for his car rental business.

- The purchase price of the car is $10,000.

- Bill paid charges of $500 to register the vehicle in the name of his business.

- Bill paid $1000 to get the car painted in his business’s brand colors and logo.

- Bill paid $600 in advance for insurance of the vehicle for the next two years.

- Bill paid a permit fee of $200. The permit will need to be renewed again after two years.

Bill plans to sell the car after 10 years for an expected selling price of $1500.

What is the depreciation base of the car?

The initial cost of the car is $11,500 (Purchase Price $10,000 + Registration cost $500 + Paint cost $1000).

Depreciation base is $10,000 [$11,500 (Initial Cost) MINUS $1500 (Salvage Value)].

The insurance cost and permit fee are not capital expenses, which is why we have excluded them from the asset’s initial cost.

Salvage Value of assets

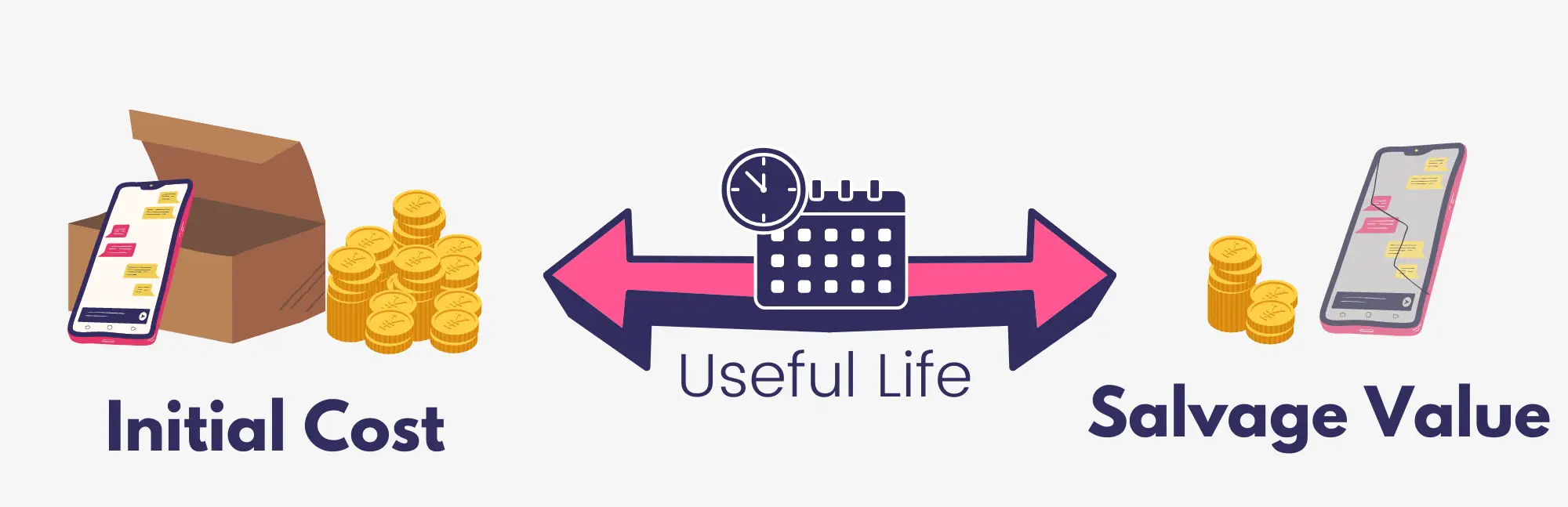

The original value of an asset is reduced each year by the amount of depreciation until it is finally reduced to its salvage or residual value at the end of its useful life.

Salvage value, also known as residual value or scrap value, is the estimated amount that an asset will fetch when it is disposed of at the end of its useful life.

You can determine the salvage value of an asset by taking into account:

- It’s useful life. The longer the asset is expected to be used, the lower its residual value;

- The current market value of similar assets that are more aged;

- Does the asset have an active market for resale? If it is a specialized asset, it might not fetch a good price towards the end of its life;

- Will any costs be incurred on disposal or removal of the asset? You may deduct these from the estimated revenue from the sale.

Depreciation Base of buildings

When a building is purchased without any land rights, the depreciation base calculation is the same as any other asset. We take the initial cost of the building and subtract its residual value.

However, when a building is acquired along with the ownership rights to the attached land, we need to calculate depreciation only on the portion of the cost relating to the building structure and exclude the land cost.

The reason for excluding land from the depreciation calculation is that land, unlike other assets, has an endless useful life, and its value does not decrease with usage.

To calculate the depreciation base of a building, we need to find its initial cost (excluding the land portion) by multiply the total price paid for the combined asset by the fair value of the building and divide it by the fair values of land and building.

Example 2

Alice purchased a shop with land rights for $50,000.

Alice seems to have struck a good bargain because the surveyor’s report states that the land’s current market value on which the shop stands to be around $40,000, and the building itself is valued at $20,000.

Alice intends to keep the shop for about ten years and sell it for a profit. After ten years, the expected value of the land is $200,000 and the building is expected to lose half its fair value during this time.

What are the amounts of the building’s depreciation base and annual depreciation expense using the straight-line method?

Initial cost of building = $50,000 x $20,000 / ($40,000 + $20,000) = $16,667.

To calculate the initial cost of the building, we have multiplied the total price paid for the shop and land ($50,000) by the fair value of the building ($20,000) and divided by the combined fair value of both assets ($40,000 Plus $20,000).

Salvage value of building = $20,000 / 2 = $10,000

Depreciation base = $16,667 (Cost) – $10,000 Salvage Value) = $6,667

Depreciation expense = $6,667 / 10 = $667 per annum.

Quiz

Question 1

The amount of depreciation expense charged over an asset’s entire useful life is equal to its depreciation base.

True

Spot on!

False

Incorrect.

Question 2

Depreciation Base is equal to initial cost _____________ salvage value.

+

Wrong answer.

_

Correct!

Question 3

What is the depreciation base of land with initial cost of $50,000?

$50,000

Wrong answer.

$0

Correct!

We do not depreciate the cost of land which is why it has a depreciation base of zero.

Question 4

If an asset has a depreciation base of $25,000 and a residual value of $10,000, how much did the asset originally cost?

$15,000

Not correct.

$25,000

Wrong answer.

$35,000

Precisely!

Depreciation base = Initial cost - salvage value.

Therefore, we can re-arrange the equation as:

Initial cost = Depreciation base + salvage value which in this case equals to $35,000 ($25,000 + $10,000).

Question 5

Barry ordered a printer costing $100 from a website for office use.

Barry also paid extra shipping costs of $10 to deliver the printer to the required business address.

In addition to the printer, Barry also bought a set of printer sheets from a stationery shop for $5.

The printer is expected to last for 5 years, after which Barry will scrap it for $20.

What is the printer’s depreciation base?

$80

Not correct.

$85

Incorrect.

$90

You're right!

The initial cost of the printer is $100 + $10 = $110.

The cost of printer paper sheets is a revenue cost and should not be counted as a capital expenditure.

Depreciation base = $110 - $20 = $90.

$95

Not correct.

$100

Wrong.

$110

Wrong answer.

$115

Not correct.

How many questions did you answer correctly?

Score Grade

5 Master

4 Pass