Understanding why a balance sheet is always expected to balance can be hard to grasp especially for beginners.

In this lesson, I explain how the different elements of a balance sheet are organized mathematically so that the totals on each of its sides remain the same.

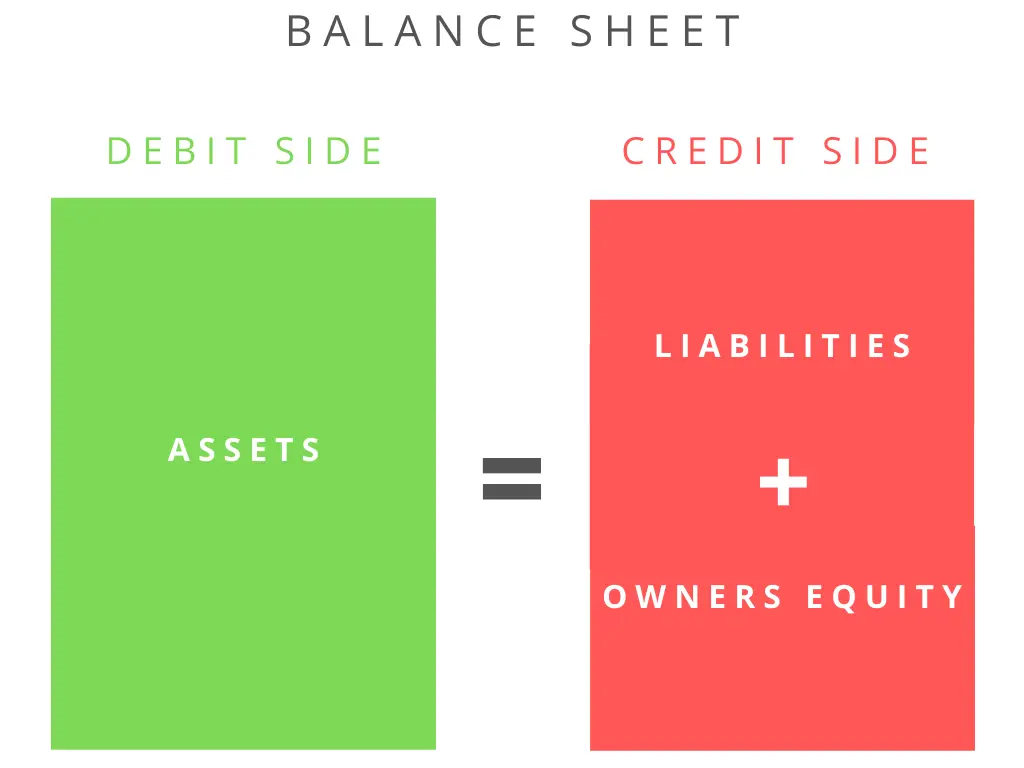

A balance sheet is a mathematical equation where the total assets of business equal the sum of its liabilities and equity.

Assets = Liabilities + Equity

Like any equation in mathematics, each side will always equal the other side as long as we follow the correct mathematical rules of addition and subtraction.

Luca Pacioli, who is widely regarded as the father of accounting, was a mathematician. It should, therefore, not be surprising that the structure of a balance sheet is grounded in mathematics.

Don’t worry, though, as we won’t be solving any quadratic equations here. Just some simple addition and subtraction will get us by.

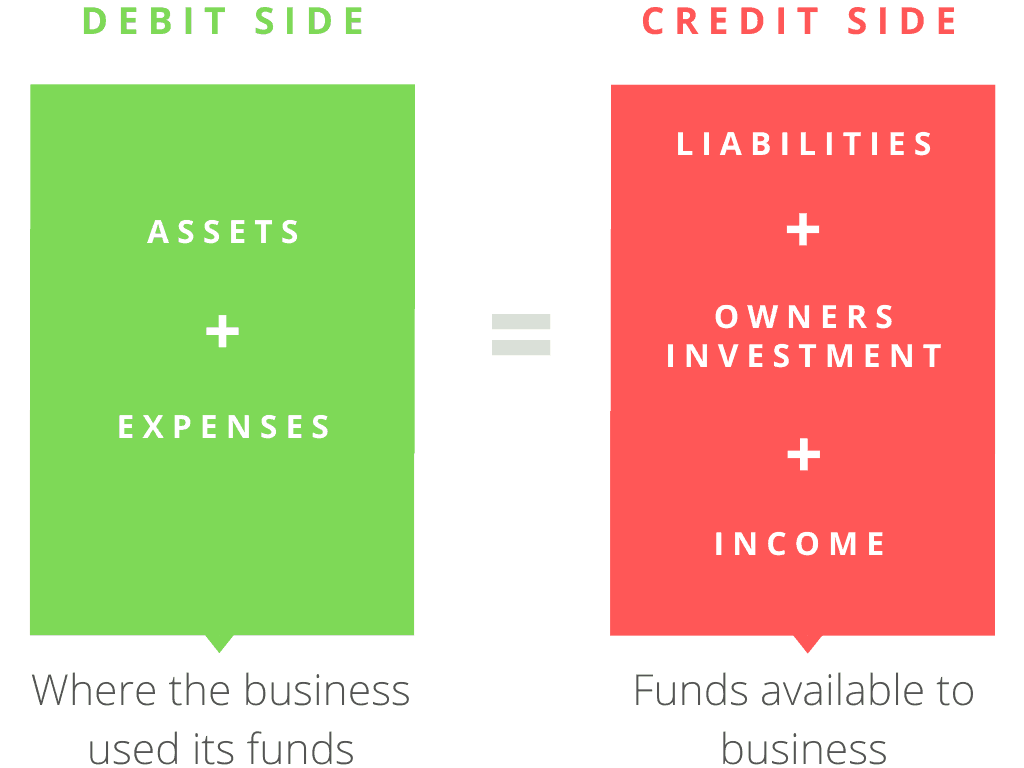

As you know, every balance sheet has two sides:

- Debit Side

- Credit Side

The following sections explain what information goes on each side of the balance sheet and how it fits in the overall context of a balance sheet.

Quick Note

In the following sections, I have presented the balance sheet in a slightly different order to help you understand the basic concept.

I will explain later how the balance sheet is structured in its usual order of presentation. So make sure you stick till the end!

Credit Side

The credit side of a balance sheet shows how many funds are available to a business.

A business has three sources of finance:

- Loan from creditors.

- Investment by owners.

- Income that is reinvested in a business.

If you add funds from all these sources, we can calculate the total funds available to a business.

Now the question is, where did these funds go? What did the business do with these funds?

The answer to these questions lies in the debit side of a balance sheet.

Debit Side

The debit side of a balance sheet shows how the business used its available funds.

Funds of a business can be used to pay for expenses such as salaries, or they can be used to purchase assets such as equipment and inventory. Any unused funds are kept as cash in hand, or saved in a bank account (which are also assets).

If an accountant does not make any mistake in compiling the financial statements, it makes sense to say that the sum of assets and expenses of a business (debit side) should equal its available funds (credit side).

We can write this in the form of an accounting equation as:

Assets + Expenses = Liabilities + Owners Investment + Income

Note that the actual balance sheet is presented a bit differently from this equation, which we will discuss in the next section.

Bringing it together

You may be wondering why expenses are shown on the debit side of a balance sheet. When we prepare a balance sheet, we actually rearrange the above equation by deducting expenses from the other side so that the owners’ equity can be calculated.

Assets = Liabilities + Owners’ Investment + Income – Expenses

Owners’ equity is the sum of the last three components of the credit side in the above equation.

We can, therefore, simplify the equation as Assets = Liabilities + Owners’ Equity, which is how a balance sheet is usually presented.

As long as all transactions are accounted for correctly , both sides of a balance sheet will always be in agreement.

The only way a balance sheet totals will mess up is if the debits and credits of an accounting transaction are not equal.

We can use an example to test if both sides of a balance sheet match after recording different types of transactions.

Example

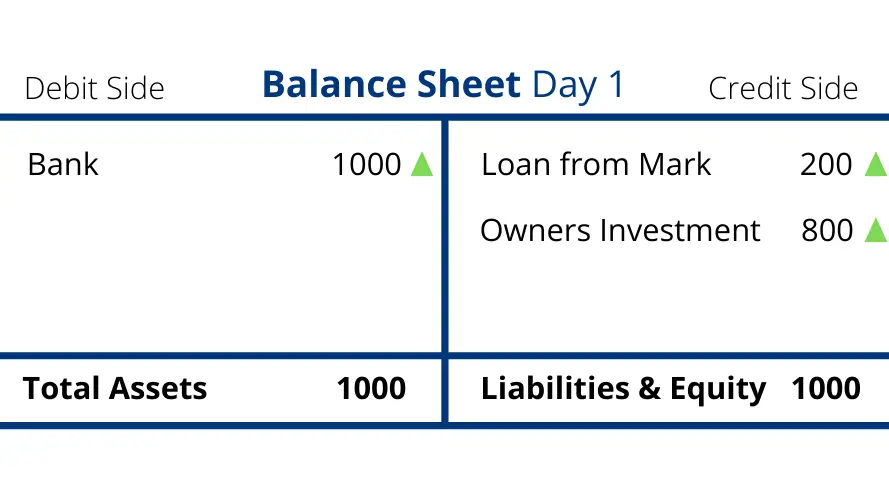

William decided to start a photography business as part of a week-long school project. He is required to prepare a balance sheet at the end of each day and make sure its totals always match.

Day 1

William opened a bank account for his business and deposited $1000 using his personal savings ($800) and a loan from his friend Mark ($200).

Both sides of the balance sheet match because the total funds that William raised for the business equal the total assets.

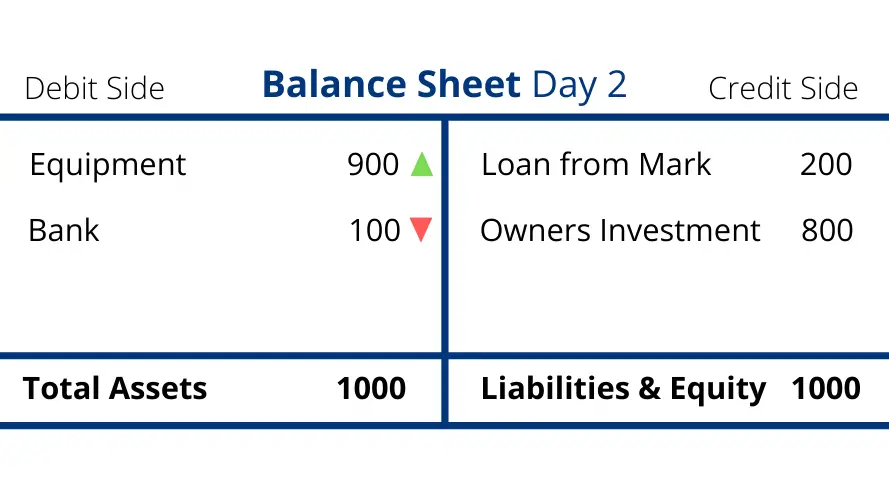

Day 2

William purchased photography equipment costing $900 paying from his bank account.

The balance sheet totals have not changed because the increase in one asset is canceled out by the decrease in another asset.

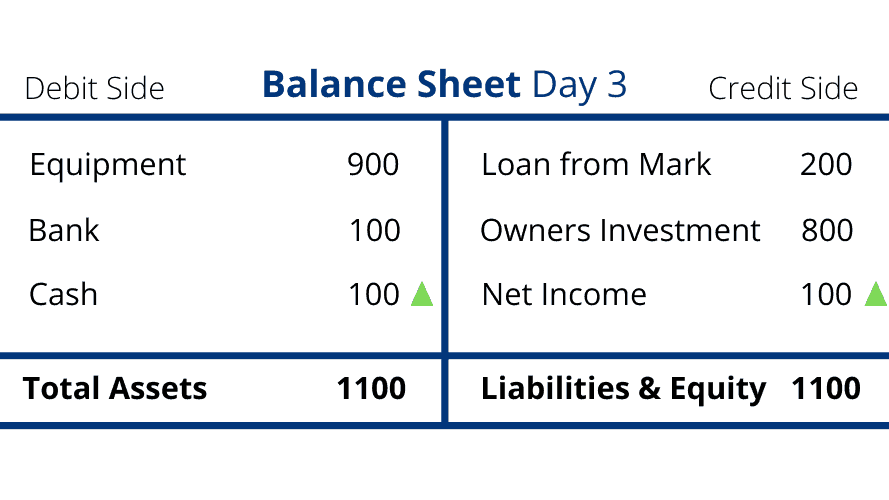

Day 3

William finally convinced someone to actually pay him for a photograph: his loving sister Jane.

He charged Jane $100 for a portrait which she paid in cash.

Income has increased both sides of the balance sheet by the same amount causing the balance sheet totals to agree once again.

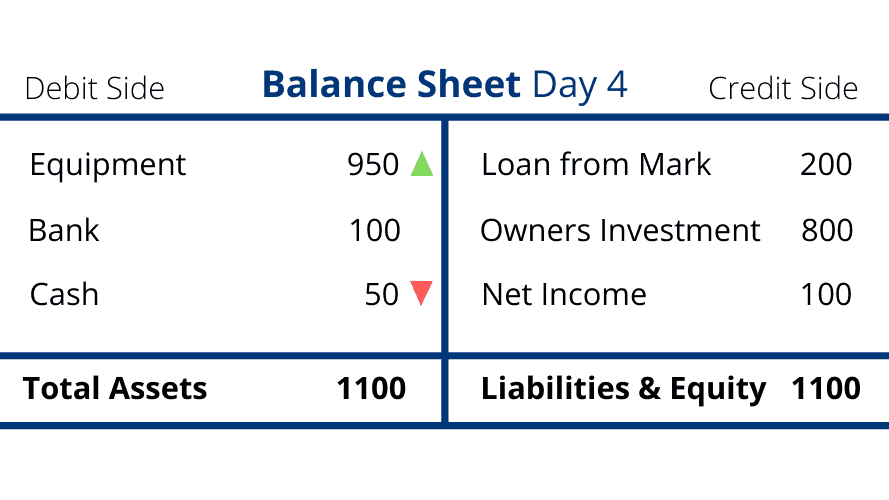

Day 4

William purchased a lens for his camera costing $50 in cash.

The transaction only changed the composition of the assets and not the total assets, which are once again equal to the total credits.

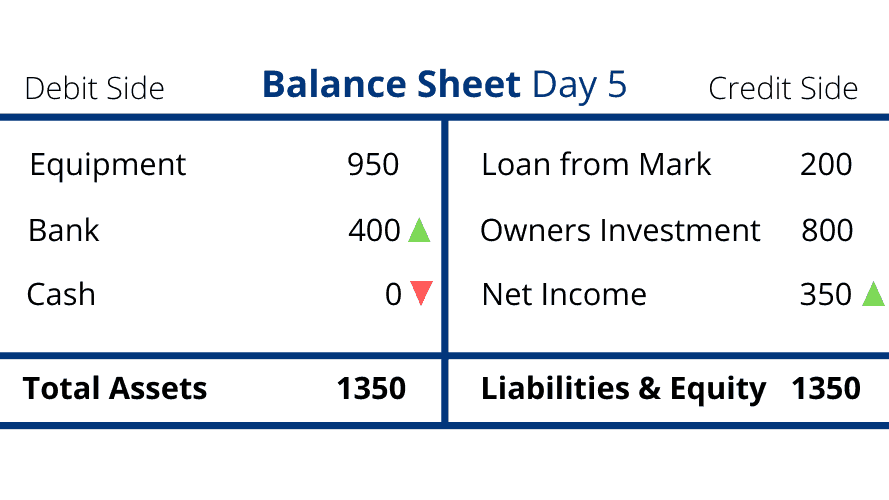

Day 5

William covered the engagement ceremony of his friend. He had to take a cab to reach the destination which cost him $50.

William charged a fee of $300, which was transferred to his bank account on the same day.

The credit side increased by $250, which is equal to the net increase in assets ($300 income less $50 expense).

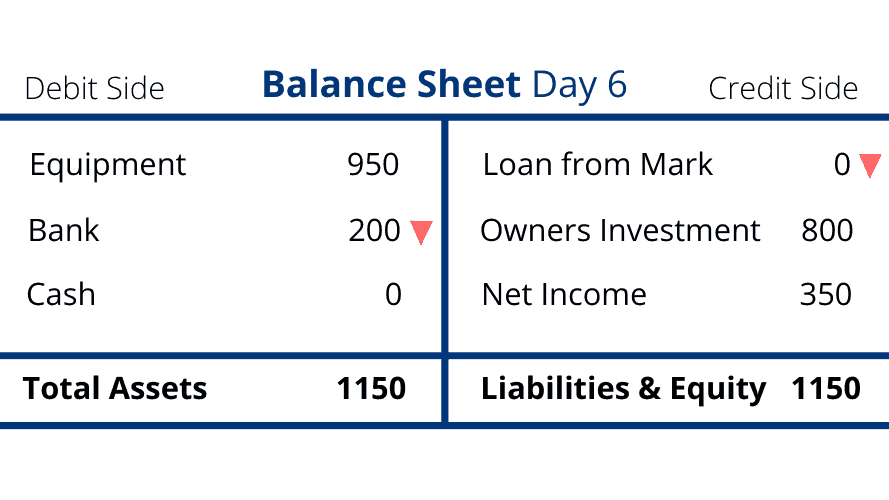

Day 6

William repaid his friend’s loan by transferring $200 from his bank account.

Assets and liabilities have decreased by the same amount.

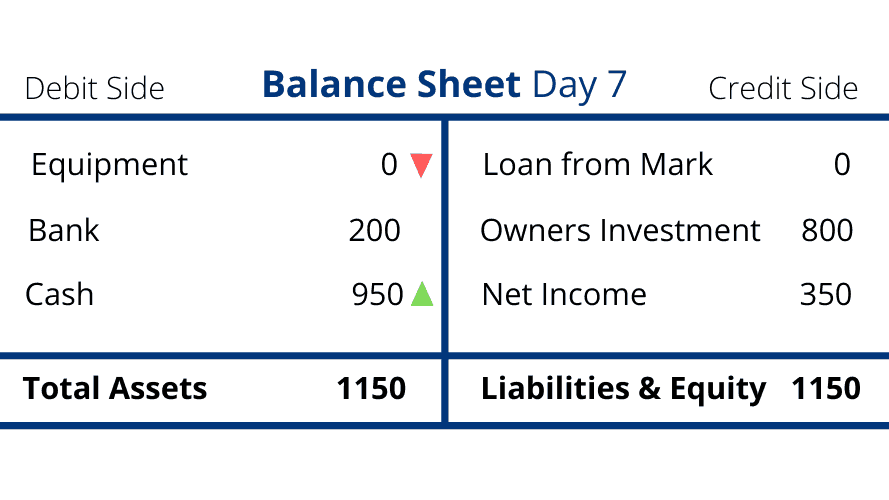

William returned all the equipment he had purchased to the store and requested a refund. The store has a one-month return policy so William received the full $950 in cash.

As expected, both sides of the balance sheet are equal at the end of the week.

Share this Page

Illustration provided by Icons8.

Related Posts