When you’re just starting to learn accountancy, it can be easy to confuse the expenses of a business with its assets. The distinction between these elements of financial statements is important for the accurate calculation of the profitability and worth of a business.

In this post, I will explain how to differentiate between assets and expenses and how you should treat both elements in the financial statements.

Difference between Assets and Expenses

Asset is a resource available to a business that gives it some form of economic benefit in the future. In comparison, an expense is the amount of resources that have already been consumed in the operations of a business during an accounting period.

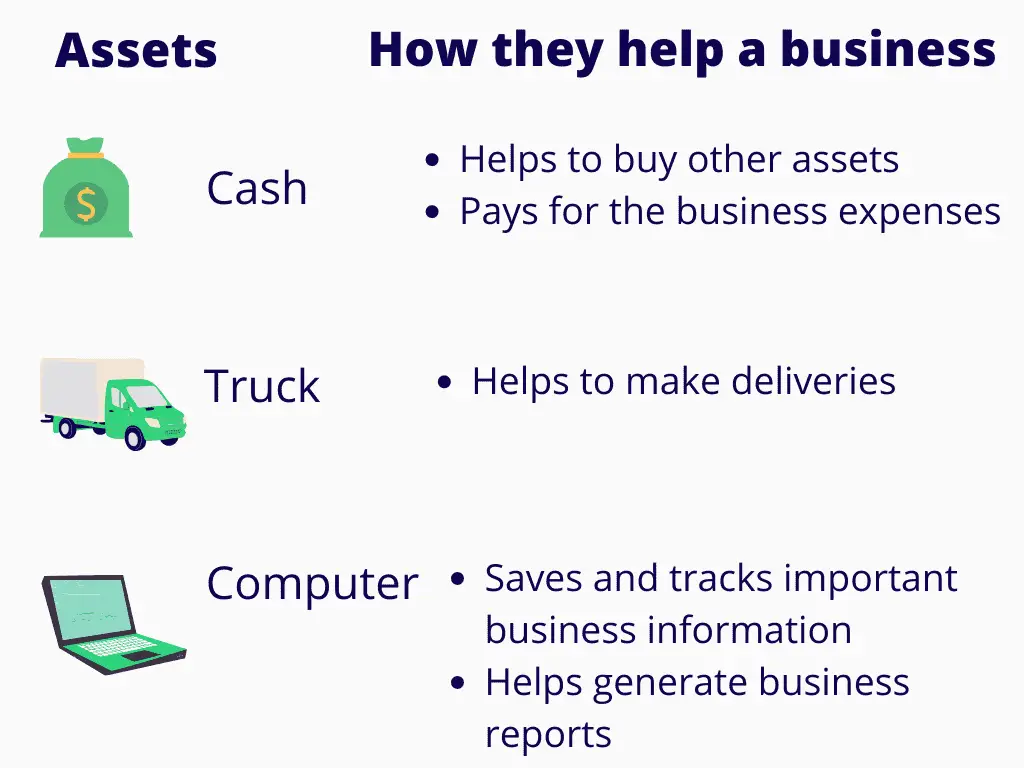

Assets include properties of all kinds that provide some value to a business in the future.

For example, cash is an asset that enables a business to pay for things in the future. A delivery truck is an asset that helps to transport things for a business.

On the other hand, expenses are the cost of resources consumed in the operations of a business during an accounting period. For example, the cost of serving meals is an expense of a restaurant.

Unlike assets, expenses do not provide a definite value to a business beyond the accounting period in which they are incurred.

For example, the manufacturing expense of a product that has already been sold to a customer has no obvious future value to a business. However, any inventory stocked in the warehouse is an asset of the business because it can be sold in the future to generate sales revenue.

The following infographic highlights the key differences between assets and expenses.

Relationship of assets and expenses

Despite the differences listed above, assets and expenses are not isolated from one another within the accounting framework.

Following examples show the types of situation in which these two elements interact in accounting:

- The asset of cash is used to pay for most expenses of a business.

- Fixed assets lose their value over time, which is treated as a depreciation expense.

Some assets are charged as an expense in subsequent periods to match them against their economic benefits.

For instance, unsold inventory is recorded as an asset at the end of an accounting period, but is subsequently expensed in the period of sale.

Accounting Treatment of Assets

An asset is recognized in the balance sheet until it is consumed in either of the following:

- Payment of liabilities.

- Payment to owners (e.g., dividends).

- Exchange of another asset (e.g., purchase of equipment using cash).

- Payment of expenses (e.g., salaries and wages).

- Loss of value due to depreciation.

An asset is not recognized in the balance sheet if it fails to meet the recognition criteria.

Following are examples of situations when the assets of a business are treated as an expense:

- It is uncertain if the business will acquire any economic benefits from the asset in the future.

For example, the cost incurred on researching a new production method cannot be capitalized as an asset because of the uncertainty regarding its commercial success.

For example, the cost incurred on researching a new production method cannot be capitalized as an asset because of the uncertainty regarding its commercial success.

- The asset is immaterial and, therefore, not relevant to the users of the financial statements. In such circumstances, the cost of tracking an asset over its useful life may exceed any benefit from the information.

For example, a tape dispenser costing $4 fits the definition of an asset. However, it makes sense to charge it as a stationery expense instead of treating it as a fixed asset and charging depreciation over its useful life.

For example, a tape dispenser costing $4 fits the definition of an asset. However, it makes sense to charge it as a stationery expense instead of treating it as a fixed asset and charging depreciation over its useful life.

Accounting Treatment of expenses

Expenses are charged to the income statement of the period in which they are incurred.

Expenses are incurred either when there is a consumption of economic resources or when a business receives economic benefits.

- The cost of sales is expensed in the accounting period in which the sales revenue is earned.

- Administrative costs are recognized as an expense in the accounting period in which the related services or goods are acquired.

For example, an office assistant’s salary will be recorded in the accounting period in which he or she has rendered services for the business.

For example, an office assistant’s salary will be recorded in the accounting period in which he or she has rendered services for the business.

- Depreciation of a fixed asset is expensed in the accounting periods that fall within its useful life.

Sometimes, it is necessary to capitalize expenses as assets in the balance sheet until their economic benefit is realized in the future accounting periods.

Examples of such costs include:

- Prepaid expenses.

- Production expenses incurred on inventory that is unsold by the end of an accounting period.

- Expenses incurred on a self-constructed asset of a business.

Quiz

How much do you know about

Assets and Expenses?

Take the free below quiz and find out!

Instructions for solving quiz:

- Click on one of the given options that you think is correct.

- If you are not sure about a question, review the lesson above.

- Mark yourself out of 7 by rewarding 1 mark for each correct answer.

Good luck!

Question 1

An ______________ is the consumption of an economic resource during a period.

Asset

Wrong answer.

Expense

Correct!

Question 2

____________ do not provide economic benefits in subsequent accounting periods.

Assets

Incorrect.

Expenses

You're right!

Question 3

_____________ do not appear on the income statement of a business.

Assets

Correct!

Expenses

Wrong answer.

Question 4

All assets are eventually expensed in the income statement.

True

Incorrect.

Only depreciable assets, inventory, and prepaid expenses are charged as an expense in future periods.

Other assets such as receivables, cash, and land are not charged as an expense although they may be used to pay for the expenses.

False

Correct!

Question 5

An asset can be treated as an expense if it is considered immaterial.

True

Spot on!

False

Incorrect.

Question 6

Which of the following is not a difference between an asset and an expense?

a) An asset is recognized in the balance sheet, whereas expenses are shown on the income statement.

b) Increase in assets is a debit entry whereas the increase in expenses is a credit.

A

Wrong answer.

B

Correct!

Assets and expenses are both recorded as a debit in accounting books.

Question 7

Which of the following costs is an asset?

a) The insurance premium paid to insure a warehouse against the risk of fire.

b) Cost of a printer sold by a retailer.

c) Cost of a laptop purchased by a company for office use.

A

Incorrect.

Insurance premium is an operational expense because the recovery of any claim (economic benefit) made by a business in the future is contingent on the outbreak of a fire in the warehouse and therefore uncertain.

Only if an insurance claim is validated by the insurance company can a business record a receivable (asset).

B

Wrong answer.

This should be considered as the cost of goods sold (expense) rather than an asset.

Had the printer remained in inventory at the end of an accounting period, or if it was intended for internal use of the business instead of resale, it would be classified as an asset.

C

Correct!

How many questions did you answer correctly?

Score Grade

7 Master

6 Pro

5 Pass

Share this Page