If you’re new to accountancy, calculating the value of ending inventory using the LIFO method can be confusing because it often contradicts the order in which inventory is usually issued.

In this lesson, I explain the easiest way to calculate inventory value using the LIFO Method based on both periodic and perpetual systems.

Last In First Out

Last In First Out (LIFO) is the assumption that the most recent inventory received by a business is issued first to its customers.

Under the LIFO method, the value of ending inventory is based on the cost of the earliest purchases incurred by a business.

For example, suppose a shop sells one of the two identical pairs of shoes in its inventory. One pair cost $5 and was purchased in January, and the second pair was purchased in February and cost $6 unit.

On the LIFO basis, we will value the cost of the shoes sold on the most recent purchase cost ($6), whereas the remaining pair of shoes in inventory will be valued at the cost of the earliest purchase ($5).

Let’s see the LIFO method in action in a more complete example below that includes a range of transactions.

Example 1 (Perpetual)

Lynda sells a particular model of desktop computers on her website.

She launched her website in January this year, and charges a selling price of $900 per unit.

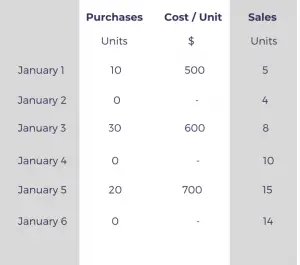

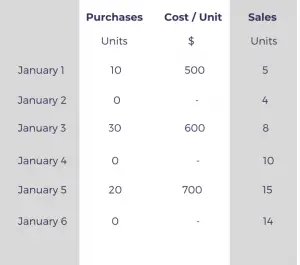

Details of her sales and purchases over the first six days of business are as follows:

Calculate the value of ending inventory, cost of sales, and gross profit for Lynda’s first six days of business based on the LIFO Method.

Ending Inventory

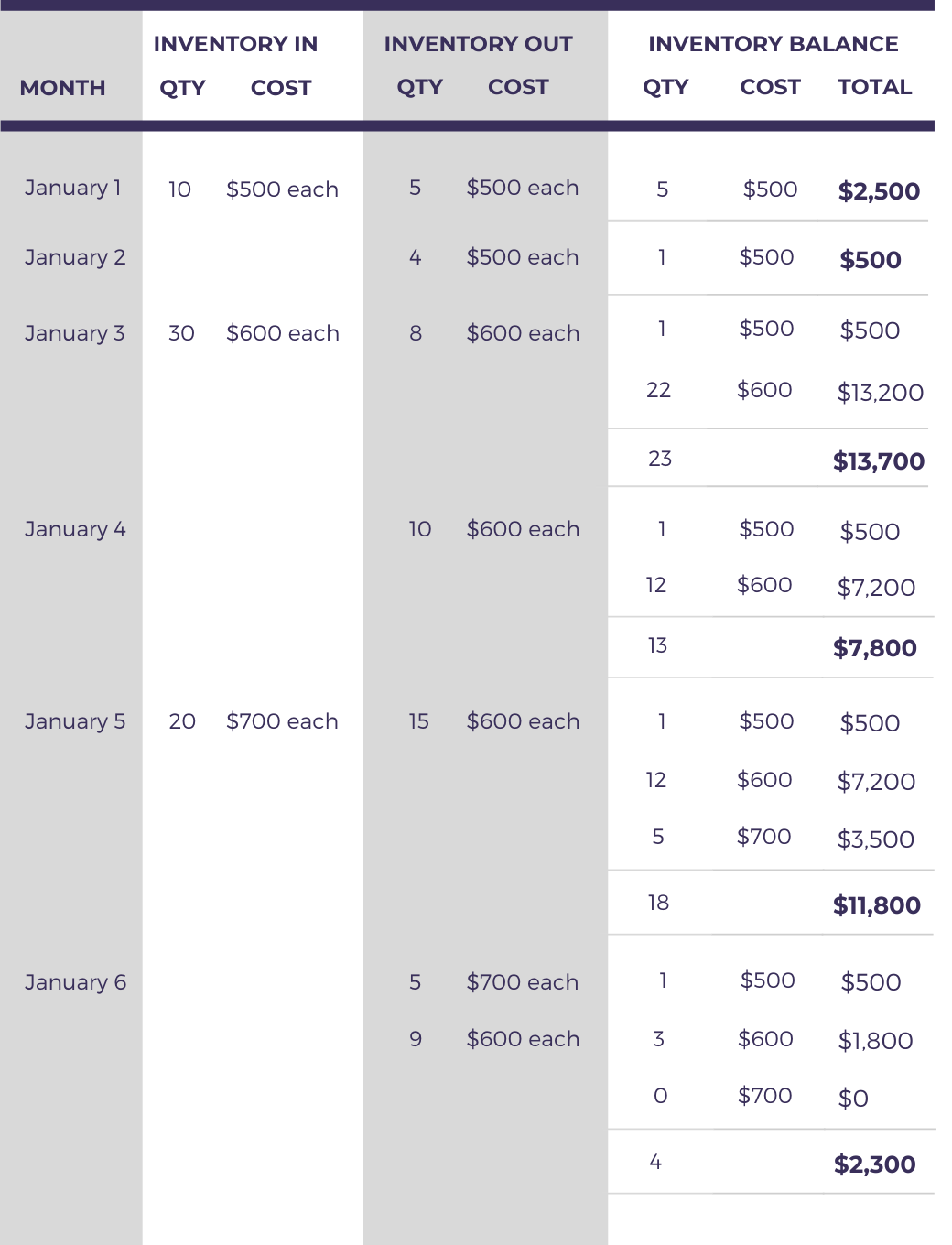

To find the value of ending inventory, we need to track additions and deletions in the computer units alongside its associated cost.

Based on the calculation above, Lynda’s ending inventory works out to be $2,300 at the end of the six days.

Let’s break down the process involved in arriving at the above value of ending inventory.

The first step is to note the additions in inventory in the left column, along with the purchase cost for each day. For example, on the first day, 10 units of inventory were added at the cost of $500 each, which we will record as follows.

Second, we need to record the quantity and cost of inventory that is sold using the LIFO basis.

If the inventory units sold during a day are equal or less than the inventory units purchased during the same day, we will assign that day’s cost to the inventory sold because it is the most recent purchase cost.

For example, only five units are sold on the first day, which is less than the ten units purchased that day. We will therefore assign $500 to each sale made that day.

Lastly, we need to record the closing balance of inventory in the last column of the inventory schedule.

To take the first day as an example, we can find the closing balance by deducting the number of units sold (5) from the number of units purchased (10), which is five units, and assign it the cost value of $500 each to calculate the total amount of $2500 (5 x $500).

When inventory balance consists of units with a different value, it is important to show those separately in the order of their purchase. Doing so will ensure that the earliest inventory appears on top, and the latest units acquired are shown at the bottom of the list.

For example, the inventory balance on January 3 shows one unit of $500 that was purchased first at the top, and the remaining 22 units costing $600 each that were later acquired shown separately below. The total number of units at the end of that day is 23.

The reason for organizing the inventory balance is to make it easier to locate which inventory was acquired most recently.

When the inventory units sold during a day are less than the units purchased on the same day, we will need to assign cost based on the previous day’s inventory balance.

For example, on January 6, a total of 14 units were sold, but none were acquired. This means that all units that were sold that day came from the previous day’s inventory balance.

Out of the 18 units available at the end of the previous day (January 5), the most recent inventory batch is the five units for $700 each.

So out of the 14 units sold on January 6, we assign a value of $700 each to five units with the remainder of 9 units valued at the cost of the next most recent batch ($600 each).

Once the value of ending inventory is found, the calculation of cost of sales and gross profit is pretty straight forward.

Cost of sales

To calculate the cost of sales, we need to deduct the value of ending inventory calculated above from the total amount of purchases.

Gross Profit

Deducting the cost of sales from the sales revenue gives us the amount of gross profit.

LIFO: Periodic Vs. Perpetual

The example above shows how inventory value is calculated under a perpetual inventory system using the LIFO method.

The periodic system is a quicker alternative to finding the LIFO value of ending inventory.

A LIFO periodic system finds the value of ending inventory by matching the cost of the earliest purchase of the accounting period to the units of ending inventory.

Unlike, perpetual inventory system that calculates the value of inventory after each issue, the periodic system provides a one-time calculation of the inventory value at the end of the period.

Therefore, the value of ending inventory under both systems will usually differ when applying the LIFO basis.

You can see the LIFO periodic method in action in the example below.

Example 2 (Periodic)

Let’s calculate the value of ending inventory using the data from the first example using the periodic LIFO technique.

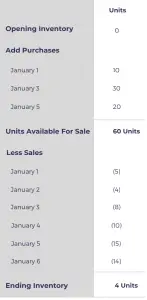

The first thing we need to calculate is the units of ending inventory.

Now that we know that the ending inventory after the six days is four units, we assign it the cost of the most earliest purchase which was made on January 1 for $500 per unit.

Value of ending inventory is therefore equal to $2000 (4 x $500) based on the periodic calculation of the LIFO Method.

This is slightly different from the amount calculated on the perpetual basis which worked out to be $2300.

The reason for the difference is that the periodic method does not take into account the precise timing of inventory movement which is accounted for in the perpetual calculation. Due to the simplification in the periodic calculation, slight variance between the two LIFO calculations can be expected.

Quiz

How much do you know about LIFO?

Instructions for solving quiz:

- Click on one of the given options that you think is correct.

- If you are not sure about a question, review the lesson above.

- Mark yourself out of 5 by rewarding 1 mark for each correct answer.

Good luck!

Question 1

LIFO method values the ending inventory on the cost of the earliest purchases.

True

Spot on!

False

Incorrect.

Question 2

In a period of falling prices, the value of ending inventory under LIFO method will be lower than the current prices.

True

Wrong.

False

You're right!

If prices are falling, earlier purchases would have cost higher which is the basis of ending inventory value under LIFO.

Question 3

The value of ending inventory is the same under LIFO whether you calculate on periodic system or the perpetual system.

True

Wrong.

False

Correct!

Question 4

A bicycle shop has the following sales, purchases, and inventory relating to a specific model during the month of January.

Opening inventory on 1 January:

1 unit costing $100

Purchases during the month:

5 January: 3 units costing $120 each

Sales during the month:

2 January: 1 unit

Ending inventory on 31 January:

3 units

a) What is the value of ending inventory using perpetual LIFO basis?

$300

Incorrect.

$320

Wrong.

$340

Wrong.

$360

Correct!

3 x $120 = $360

According to the perpetual timeline, the only sale made during the month is from the opening inventory which means that the ending inventory is entirely based on the 3 units purchased during the month.

b) If you use the periodic method of LIFO, what will be the value of ending inventory?

$300

Incorrect.

$320

Wrong.

$340

You're right!

1 x $100 + 2 x $120 = $340

If we apply the periodic method, we will not concern ourselves with when purchases and sales occur during the period. We will simply assume that the earliest units acquired by the shop are still in inventory. The earliest unit is the single unit in the opening inventory and therefore the remaining two units will be assumed to be from the current month's purchase.

$360

Wrong.

How many questions did you answer correctly?

Score Grade

5 Master

4 Pro

3 Pass

Illustration provided by Icons8.