Finding the value of ending inventory using the FIFO method can be tricky unless you familiarize yourself with the right process.

In this lesson, I explain the FIFO method, how you can use it to calculate the cost of ending inventory, and the difference between periodic and perpetual FIFO systems.

First In First Out

In accounting, First In, First Out (FIFO) is the assumption that a business issues its inventory to its customers in the order in which it has been acquired.

Under the FIFO Method, inventory acquired by the earliest purchase made by the business is assumed to be issued first to its customers.

When a business buys identical inventory units for varying costs over a period of time, it needs to have a consistent basis for valuing the ending inventory and the cost of goods sold.

To explain the accounting problem, let’s say that a stationery shop has just two calculators in its inventory. One of them was purchased for $3, and the other one was acquired for $4 on a later date. If the shop was to sell one calculator in the future, what value do we place on the calculator that is sold, and the other calculator that is still in inventory?

First-in, first-out (FIFO) is one of the methods we can use to place a value on the ending inventory and the cost of inventory sold. If we apply the FIFO method in the above example, we will assume that the calculator unit that is first acquired (first-in) by the business for $3 will be issued first (first-out) to its customers. By the same assumption, the ending inventory value will be the cost of the most recent purchase ($4).

Let’s apply the FIFO method in a more comprehensive example below.

Example 1 (Perpetual)

Bill sells a specific model of a toaster on his website for $12 apiece.

On 1 January, Bill placed his first order to purchase 10 toasters from a wholesaler at the cost of $5 each.

The wholesaler provides a same-day delivery service and charges a flat delivery fee of $10 irrespective of the order size.

On 2 January, Bill launched his web store and sold 4 toasters on the very first day.

On 3 January, Bill purchased 30 toasters, which cost him $4 per unit and sold 3 more units.

On 4 January, Bill managed to sell 10 more units.

Calculate the value of Bill’s ending inventory on 4 January and the gross profit he earned on the first four days of business using the FIFO method.

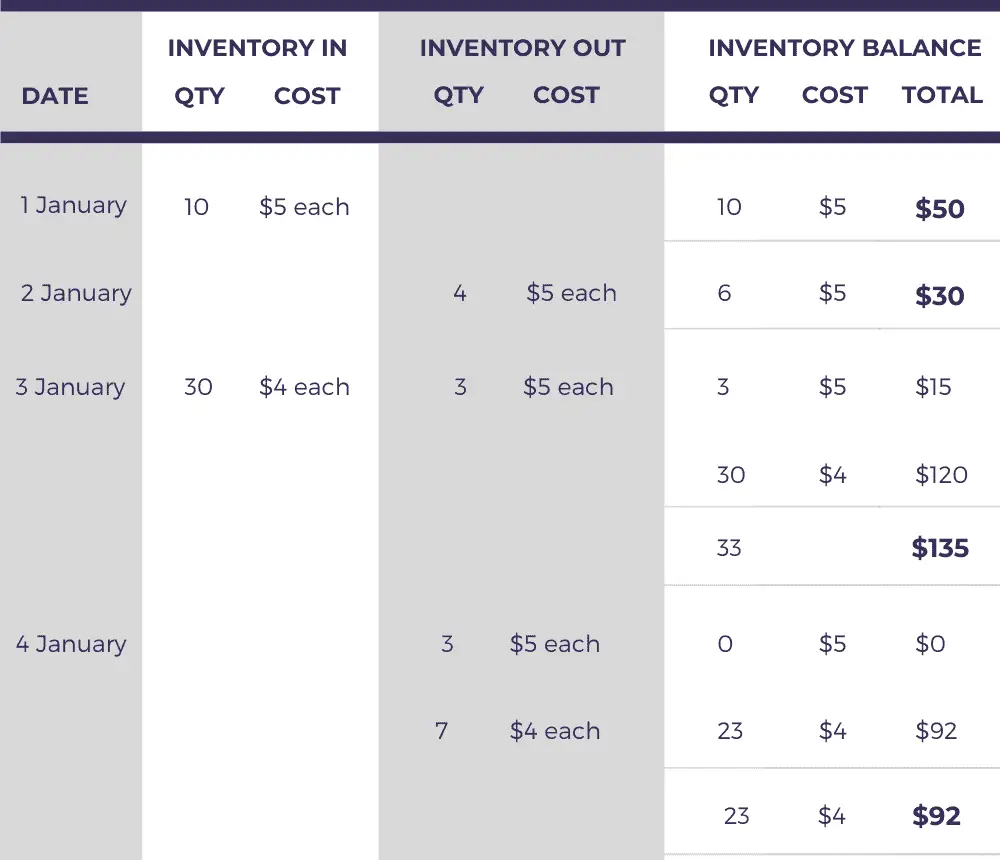

To find the cost valuation of ending inventory, we need to track the cost of inventory received and assign that cost to the correct issue of inventory according to the FIFO assumption.

The ending inventory at the end of the fourth day is $92 based on the FIFO method.

To arrive at this number, we need to work our way in three steps.

First, we add the number of inventory units purchased in the left column along with its unit cost.

Second, every time a sale occurs, we need to assign the cost of units sold in the middle column.

Third, we need to update the inventory balance to account for additions and subtractions of inventory.

To determine what cost needs to be assigned in the ‘Inventory Out’ column, we need to consider:

- How many units are sold?

- How many units are available at the start of the day?

- Are any additional units acquired on the day of the sale?

- The order in which the inventories are acquired.

On the first day, we have added the details of the purchased inventory.

On the second day, ten units were available, and because all were acquired for the same amount, we assign the cost of the four units sold on that day as $5 each.

The inventory balance at the end of the second day is understandably reduced by four units.

On the third day, we assign the cost of the three units sold as $5 each. This is because even though we acquired 30 units at the cost of $4 each the same day, we have assumed that the sales have been made from the inventory units that were acquired earlier for $5 each.

Ten units were sold on the fourth day. At the start of that day, we had a total of 33 units. Three units costing $5 each were purchased earlier, so we need to remove them from the inventory balance first, whereas the remaining seven units are assigned the cost of $4 each.

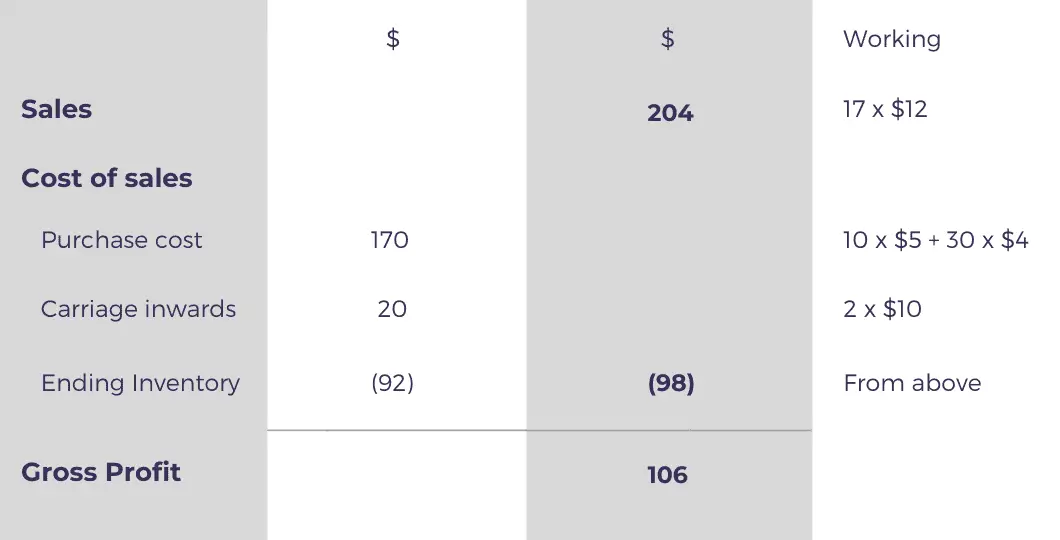

Bill’s gross profit for the first four days is:

FIFO: Periodic Vs. Perpetual

The example above shows how a perpetual inventory system works when applying the FIFO method.

Perpetual inventory systems are also known as continuous inventory systems because they sequentially track every movement of inventory.

On the other hand, Periodic inventory systems are used to reverse engineer the value of ending inventory.

As we shall see in the following example, both periodic and perpetual inventory systems provide the same value of ending inventory under the FIFO method.

Example 2 (Periodic)

In the first example, we worked out the value of ending inventory using the FIFO perpetual system at $92.

Here’s a summary of the purchases and sales from the first example, which we will use to calculate the ending inventory value using the FIFO periodic system.

Purchases

1 January 10 units for $5 each

3 January 30 units for $4 each

Sales

2 January 4 units for $12 each

3 January 3 units for $12 each

4 January 10 units for $12 each

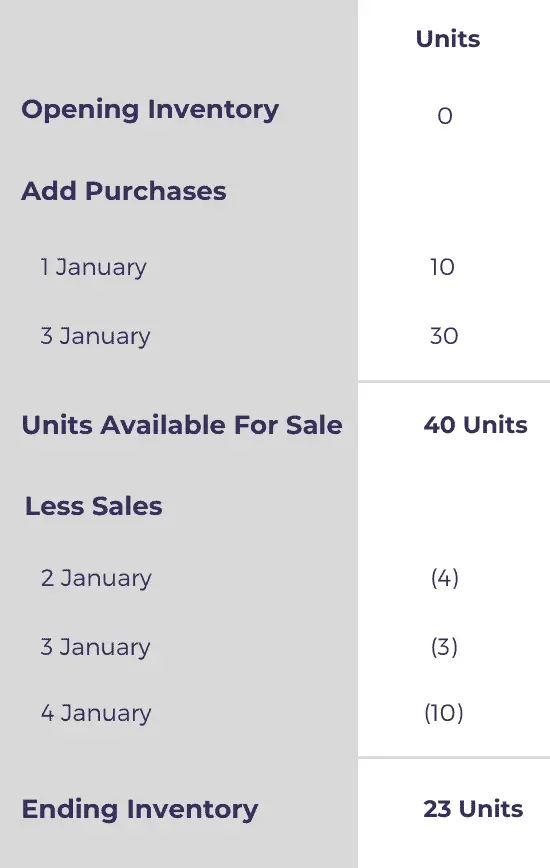

To calculate the value of ending inventory using the FIFO periodic system, we first need to figure out how many inventory units are unsold at the end of the period.

Our example has a four-day period, but we can use the same steps to calculate the ending inventory for a period of any duration, such as weeks, months, quarters, or years.

Now that we have ending inventory units, we need to place a value based on the FIFO rule. To do that, we need to see the cost of the most recent purchase (i.e., 3 January), which is $4 per unit.

Because the volume of the most recent purchase (i.e., 30 units) is lower than the units of the ending inventory (i.e., 23 units), we will value the entire ending inventory units using the most recent purchase cost, which is $4 per unit.

Therefore, the value of ending inventory is $92 (23 units x $4), which is the same amount we calculated using the perpetual method.

Suppose the number of units from the most recent purchase been lower, say 20 units. We will then have to value 20 units of ending inventory on $4 per unit (most recent purchase cost) and the remaining 3 units on the cost of the second most recent purchase (i.e., $5 per unit).

Even though the periodic inventory system provides the value of ending inventory more quickly, it does not give timely inventory management information, making it only suitable for tiny businesses with low stock turnover.

Quiz

How much do you know about FIFO?

Instructions for solving quiz:

- Click on one of the given options that you think is correct.

- If you are not sure about a question, review the lesson above.

- Mark yourself out of 4 by rewarding 1 mark for each correct answer.

Good luck!

Question 1

In the FIFO Method, the value of ending inventory is based on the cost of the most recent purchases.

True

Spot on!

False

Incorrect.

Question 2

In a period of inflation, the cost of ending inventory decreases under the FIFO method.

True

Incorrect.

False

Correct!

Because the value of ending inventory is based on the most recent purchases, a jump in the cost of buying is reflected in the ending inventory rather than the cost of goods sold.

Question 3

Under FIFO, the value of ending inventory is the same whether you calculate on the periodic basis or the perpetual basis.

True

You're right!

False

Wrong.

Question 4

A guitar shop has three identical guitars available in inventory.

The first guitar was purchased in January for $40.

The second guitar was bought in February for $50.

The third guitar was acquired in March for $60.

If the shop sells one of the guitars for $100 in April, what is the value of ending inventory on a FIFO basis?

$90

Incorrect.

$100

Wrong.

$110

Correct!

$50 + $60 = $110.

On the basis of FIFO, we have assumed that the guitar purchased in January was sold first. The remaining two guitars acquired in February and March are assumed to be unsold.

$200

Wrong.

Inventory is valued at cost unless it is likely to be sold for a lower amount.

How many questions did you answer correctly?

Score Grade

4 Master

3 Pass

Illustrations provided by Icons8.