Sum of the Years’ Digits (SYD) is a type of accelerated depreciation method that has a unique way of calculating the depreciation expense.

In this article, I explain the 5 Steps required to calculate the depreciation expense using the sum of the years’ digits method. Don’t forget to test your knowledge about this depreciation method by solving the free quiz at the end of the article!

Sum of the Years' Digits Depreciation

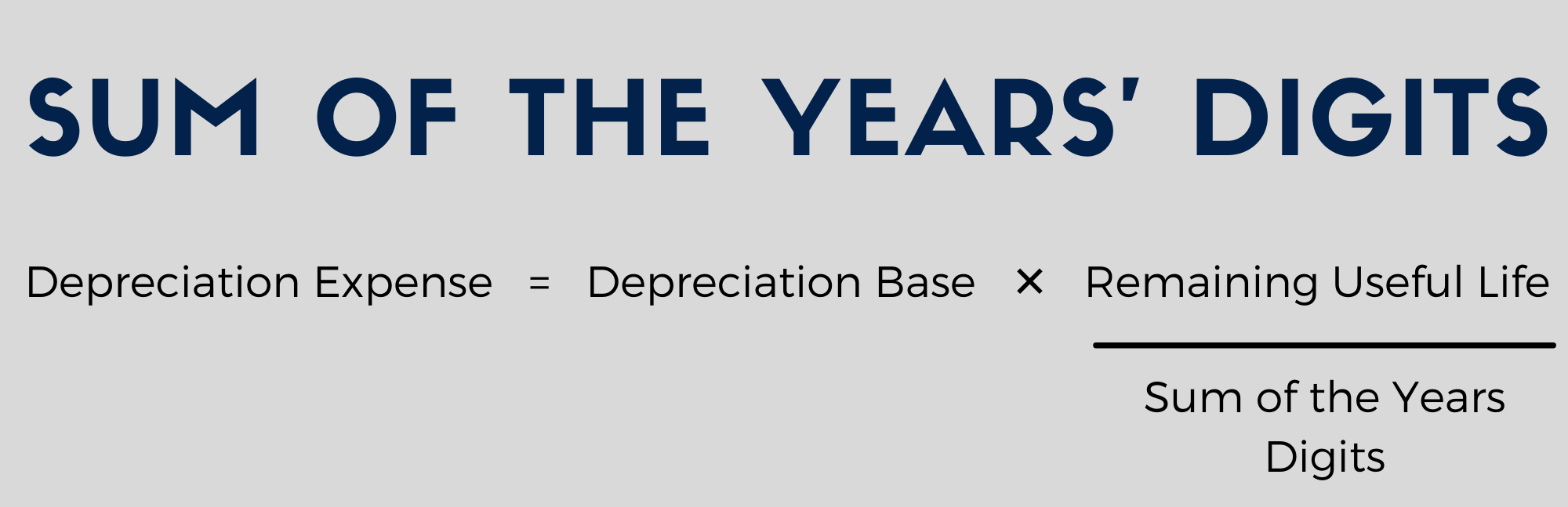

Sum of the Years’ Digits Method involves finding the sum of all digits between zero and the number of years in the asset’s useful life. Depreciation expense under this method is calculated by multiplying the depreciable cost of an asset by the fraction of its remaining useful life and the sum of its years’ digits.

Don’t worry if all this seems a bit confusing. The following sections will explain everything you need to learn to calculate depreciation using the sum of the years’ digits method, so make sure to stick till the end!

Formula for calculating depreciation

5 Steps for calculating Depreciation

Step 1: Calculate the Sum of the Years’ Digits

The sum of years’ digits is simply an addition of all numbers between zero and the number of years of an asset’s useful life.

For example, if an asset has a useful life of 5 years, the sum of its years’ digits will equal 15 (1 + 2 + 3 + 4 + 5).

We only need to calculate this value one time in an asset’s life when we estimate its depreciation for the first time. We will use the same value to calculate the depreciation expense of the future accounting periods.

Step 2: Calculate the depreciation base

An asset’s depreciation base is its initial cost, minus any salvage or residual value at the end of its useful life.

For example, if an asset costs $1000 and has a salvage value of $200, its depreciation base is $800.

Like the sum of the years’ digits calculated in Step 1, the depreciation base does not change over the asset’s life and therefore only needs to be calculated once.

Step 3: Calculate the Remaining Useful Life

For the purpose of estimating depression using the SYD method, this is the number of remaining years of an asset’s useful life at the start of each year.

For example, to calculate the depreciation of an asset with a useful life of 3 years, we will count the remaining useful life of 3 years in year 1, 2 years in year 2, and 1 year in year 3.

The remaining useful life is the only value in the SYD depreciation formula that varies from one accounting period to another.

Step 4: Calculate the Depreciation expense

Using the depreciation formula, we can calculate the amount of depreciation for each year of the asset’s life using the values calculated in Steps 1 to 3.

The following example shows how you can work your way through each of the above steps to calculate depreciation using the sum of the years’ digits method.

Example 1

A delivery truck is acquired on 1 January 2020 for $12,000 and has:

- A useful life of 4 years

- A salvage value of $2000

Using the sum of the years’ digits method, What is the amount of depreciation expense of the delivery truck to be recorded in the financial statements prepared on 31 December each year over its useful life?

Step 1: Calculate Sum of the Years’ Digits

To figure out the depreciation expense of each year, we first need to calculate is the sum of the years digits. Since the useful life of the truck is four years, we need add all numbers that fall between 4 and zero to find the sum.

Sum of the years’ digits = 4 + 3 + 2 + 1 = 10.

Step 2: Calculate the Depreciation Base

We need to deduct the salvage value ($2000) from the initial cost ($12000) to calculate the delivery truck’s depreciation base.

Depreciation base = $12,000 – $2,000 = $10,000.

Step 3: Calculate the Remaining Useful Life

To find the delivery truck’s remaining useful life, we need to count it from the start of each year rather than the end. This may seem strange to you at first, but you will get the hang of it soon with practice.

For calculating depreciation for the first accounting period that ends on 31 December 2020 (Year 1), the remaining useful life of the delivery truck will be taken as 4 years. For the next accounting period that ends on 31 December 2021 (Year 2), the remaining useful life will be 3 years. For the Years 3 and 4, the remaining useful life will be 2 and 1 respectively.

Step 4: Calculate the depreciation expense

If an asset is acquired on the first day of an accounting period or if it is the accounting policy to charge a full year’s depreciation in the year the asset is received, this will be the last step of the SYD depreciation calculation.

However, where the asset is received during an accounting period, and the business charges partial-year depreciation in the first year, we will proceed to Step 5 to allocate the depreciation expense over the relevant accounting periods.

Step 5: Apportion the depreciation expense to the accounting periods

Based on the depreciation expense calculated for each year of the asset’s life in Step 4, calculate the depreciation amount that needs to be charged for each accounting period.

To understand this last step, let’s change the assumptions of the earlier example.

Instead of assuming that the asset is conveniently purchased on the first day of the accounting period in Example 1, we now assume the same asset is purchased nine months into the accounting period and see how it affects the depreciation calculation.

Example 2

A delivery truck is acquired on 1 October 2020 for $12,000 and has:

- A useful life of 4 years

- A salvage value of $2000

Using the sum of the years’ digits method, What is the amount of depreciation expense of the delivery truck to be recorded in the financial statements prepared on 31 December each year over its useful life?

Step 1: Calculate Sum of the Years’ Digits

Sum of the years’ digits = 4 + 3 + 2 + 1 = 10.

Step 2: Calculate the Depreciation Base

Depreciation base = $12,000 – $2,000 = $10,000.

Step 3: Calculate the Remaining Useful Life

We need to count the remaining useful life from the asset’s timeline rather than the accounting periods’ perspective.

For calculating depreciation for the asset’s first year that ends on 30 September 2021 (Year 1), we will count the remaining useful life of 4 years. For the next year of the asset’s life that ends on 30 September 2022 (Year 2), the remaining useful life will be counted as 3 years. For Years 3 and 4 of the asset, the remaining useful life will be counted as 2 and 1, respectively.

Step 4: Calculate the depreciation expense

Before calculating how much depreciation is charged to each accounting period in Step 5, we first need to calculate the depreciation expense for each year of the asset life.

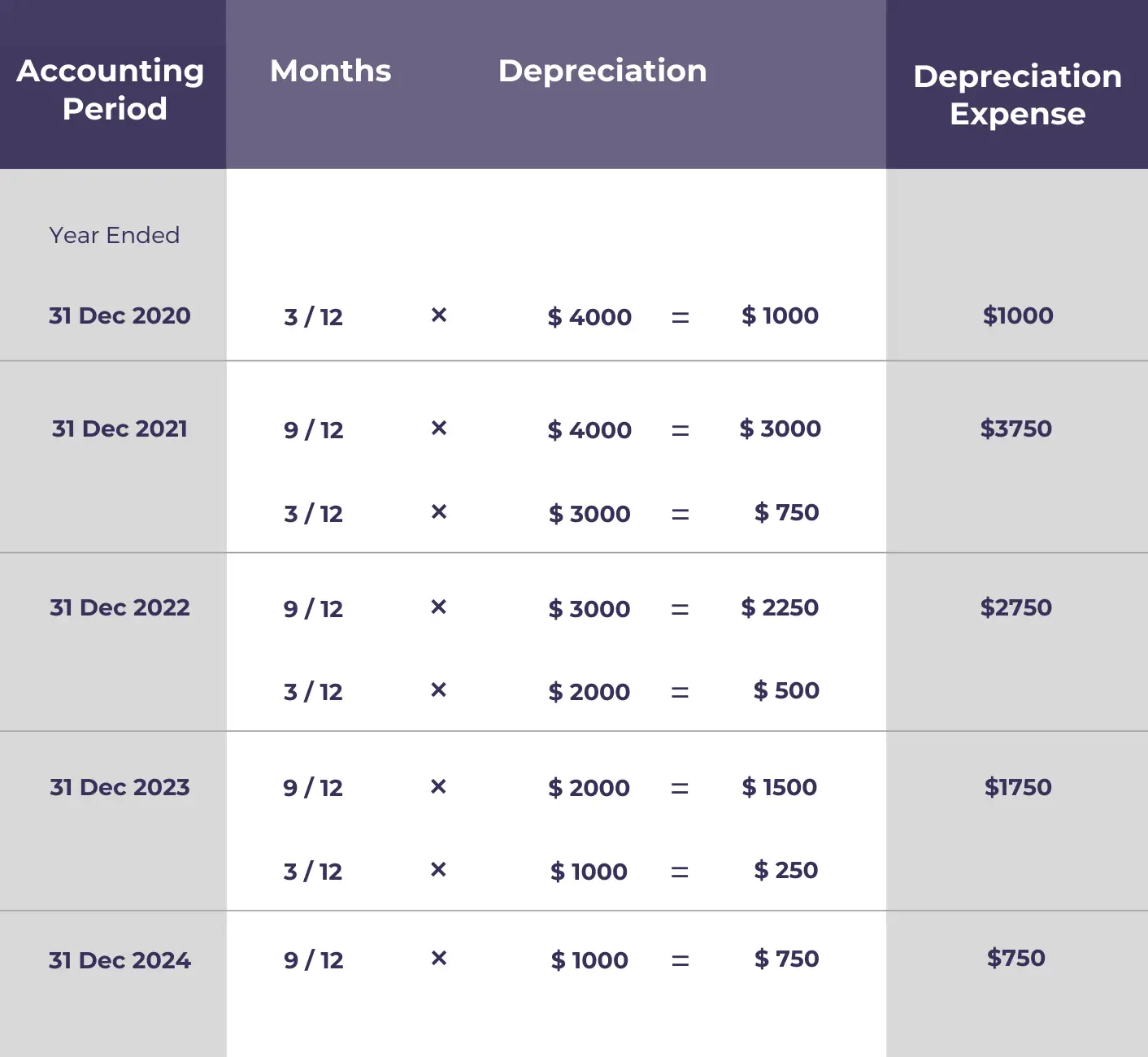

Step 5: Apportion the depreciation expense to the accounting periods

To calculate how much depreciation needs to be charged to each accounting period, we need to see the depreciation expense of each year of the asset (Step 4) that overlaps each accounting period.

For example, in the first accounting period that ends on 31 December 2020, only 3 months out of the first year of the asset overlaps. So we charge 3/12 of the first year’s depreciation expense ($4000) to the accounting period that ends on 31 December 2020.

In the second accounting period ending on 31 December 2021, 9 months out of the first year of the asset overlaps as well as 3 months out of the asset’s second year. Therefore, the depreciation expense for the second accounting period is equal to 9/12 ✕ $4000 plus 3/12 ✕ $3000.

Here’s the complete calculation for Step 5.

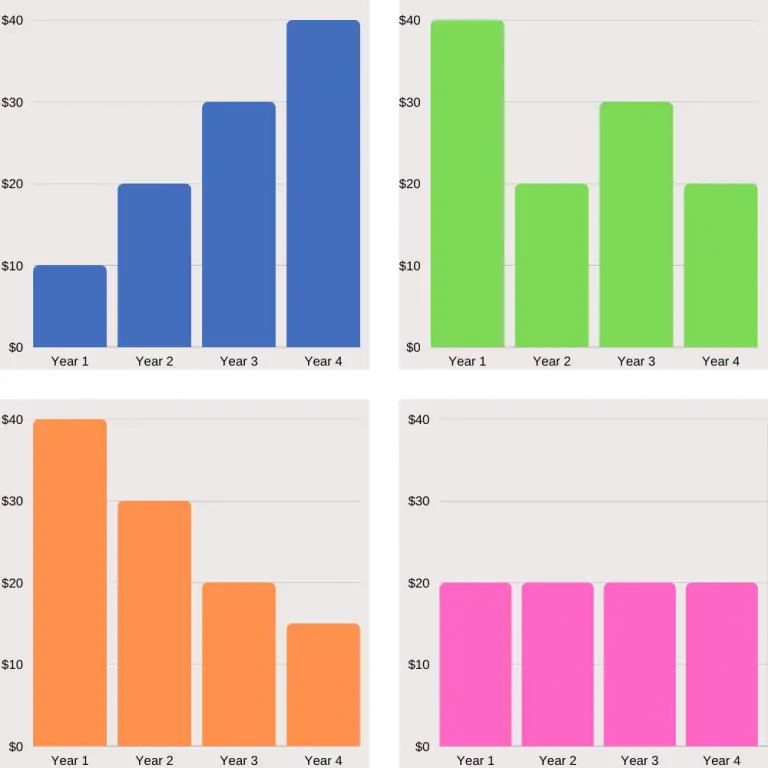

Question 1

Which of the following graphs most closely represents the sum of the years’ digits depreciation?

Blue

Wrong answer.

Green

Incorrect!

Orange

You're right!

Pink

Wrong answer.

Question 2

What is missing in the sum of the years’ digits depreciation formula?

Years of useful life

Wrong answer.

Remaining useful life

Correct!

Depreciation %

Incorrect.

Question 3

What is the sum of the years’ digits of an asset having a useful life of 60 months?

10

Incorrect.

15

You're right!

60 months equal to 5 years (60/12).

And 1+2+3+4+5 is equal to 15.

21

Wrong answer.

Question 4

An asset is purchased on 1 July 2020 and has an estimated useful life of 6 years.

When calculating depreciation using the SYD method for the year ended 30 June 2022, what value will be entered in the depreciation formula for ‘remaining useful life’?

6 years

Wrong answer.

5 years

Correct!

To calculate depreciation using the SYD formula, we need to input the remaining useful life of the asset at the start of the period (1 July 2021) which is 5 years.

4 years

Wrong answer.

Question 5

Beth purchased a display shelf for her bakery costing $10,000 on 1 January 2020. The has a useful life of 4 years after which it is expected to have no residual value.

What is the net book value of the shelf that will appear on the balance sheet on 31 December 2021 if it is depreciated using the sum of the years’ digits method?

$7000

Wrong answer.

$6000

Incorrect.

$5000

Wrong answer.

$4000

Incorrect.

$3000

You're right!

Sum of the years is 10 (1+2+3+4).

Depreciation for Year 1 is $4000 ($10,000 ✕ 4 ÷ 10).

Depreciation for Year 2 is $3000 ($10,000 ✕ 3 ÷ 10).

Net book value on 31 December 2021 is $10,000 - $4000 - $3000 = $3000.

How many questions did you answer correctly?

Score Grade

5 Master

4 Pass