Average Cost Method

Average Cost Method calculates the value of ending inventory based on the weighted average of the purchase cost incurred during an accounting period and the value of the opening inventory.

To explain the basic principle of the average cost method, let’s assume there are just two identical inventory units.

- The first unit was purchased for $5 on 1 January.

- The second unit was purchased for $7 the next day.

If one of the units is sold on 3 January, what value do we assign to the unit of sale and the unit remaining in inventory using the average cost method?

In the average cost method, we will assume that the unit sold and the ending inventory unit are both valued at the average cost of the two units, which is $6 [($5+$7) ÷ 2].

While the example above is a bit oversimplified, it illustrates the average cost method’s basic assumption.

In the following examples, I explain the working of average cost calculation in a perpetual and a periodic system.

Example 1 (Perpetual)

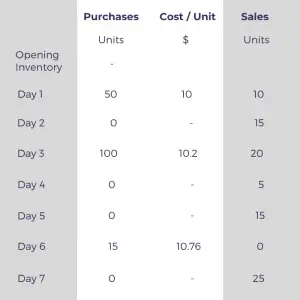

Amy recently opened a grocery store. She wants to figure out her profitability for each product category at the end of her first week of operation.

On Day 1, Amy purchased 50 bottles of a particular soda brand at the cost of $10 per bottle.

On Day 3, Amy bought 100 more bottles at the cost of $10.2 per bottle.

On Day 6, Amy purchased an additional 15 bottles at the cost of $10.76 per unit.

Amy sold the 90 bottles in the first week for $14 apiece in the following order:

Day 1 10 units

Day 2 15 units

Day 3 20 units

Day 4 5 units

Day 5 15 units

Day 6 0 units

Day 7 25 units

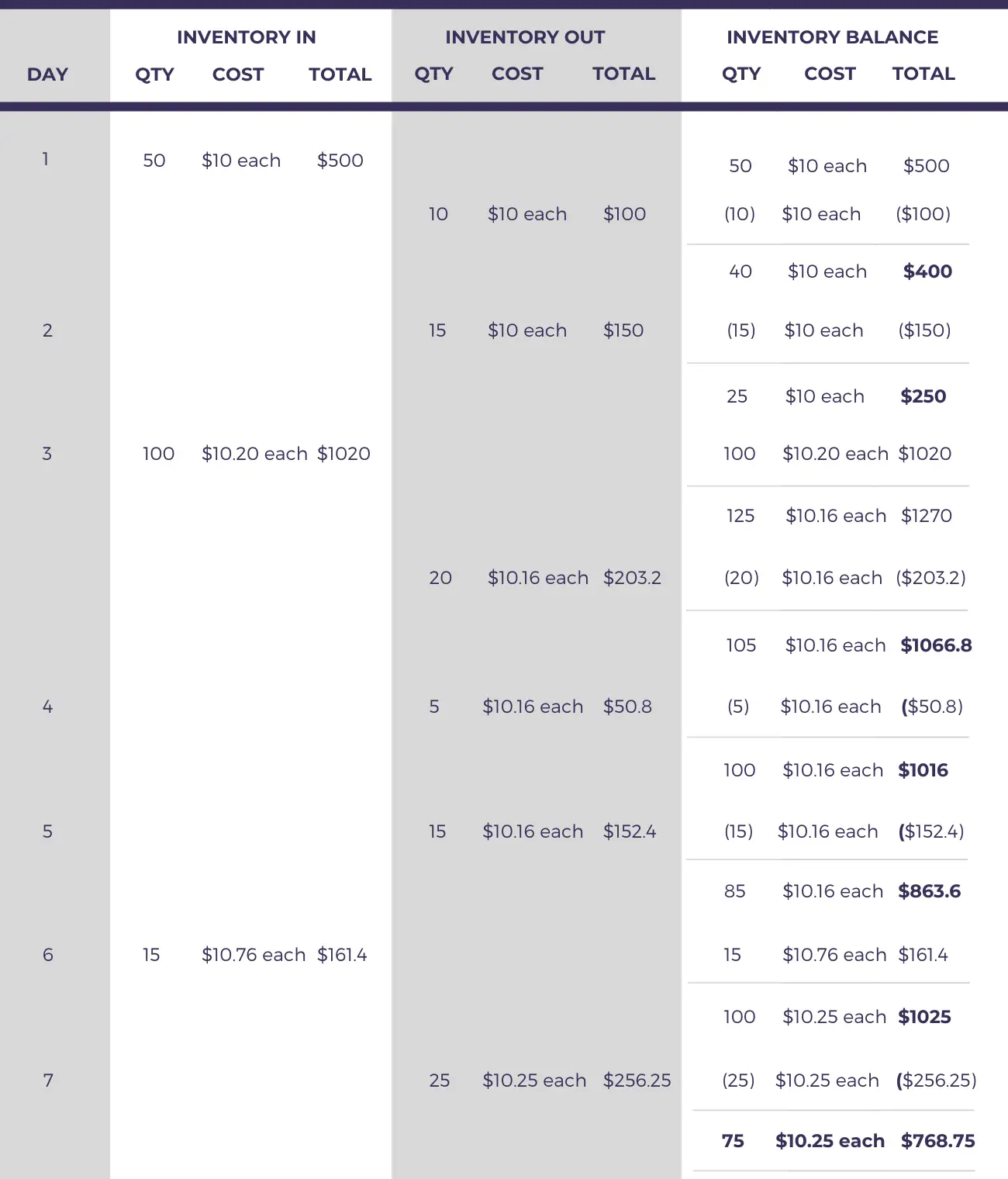

Using the Average Cost Method, calculate the values of ending inventory, cost of sales, and gross profit at the end of the first week.

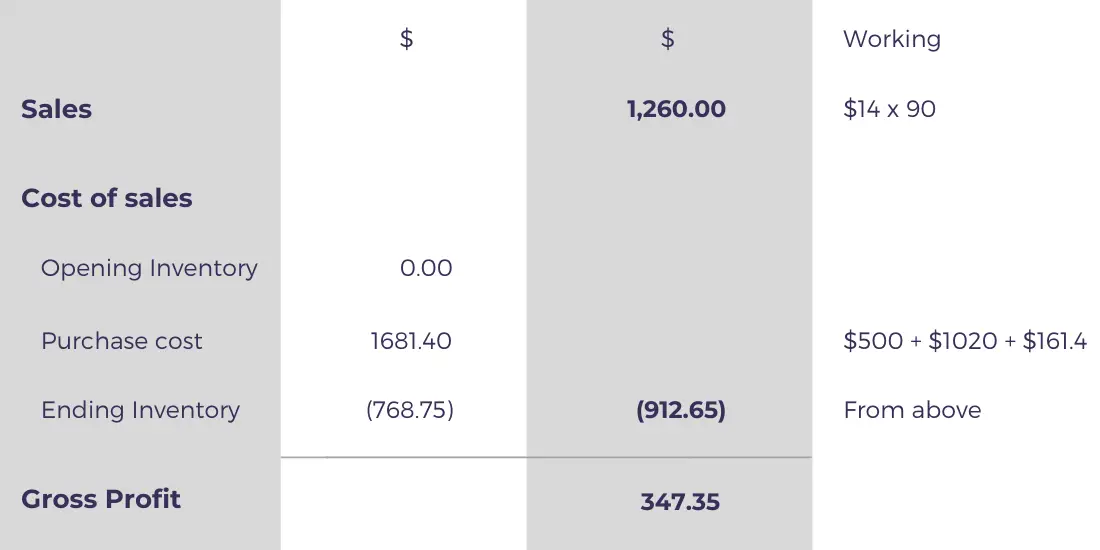

The value of Amy’s ending inventory of the soda bottles is $768.75 (75 units valued at $10.25 each) at the end of Day 7.

To arrive at this number, we have recalculated the average inventory cost after each addition and applied to each subsequent inventory issue until the next purchase.

For example, on the first day, the purchase cost is $10, which is charged as the cost of all sales made until the next purchase made on the third day (i.e., sales on Day 1 and Day 2).

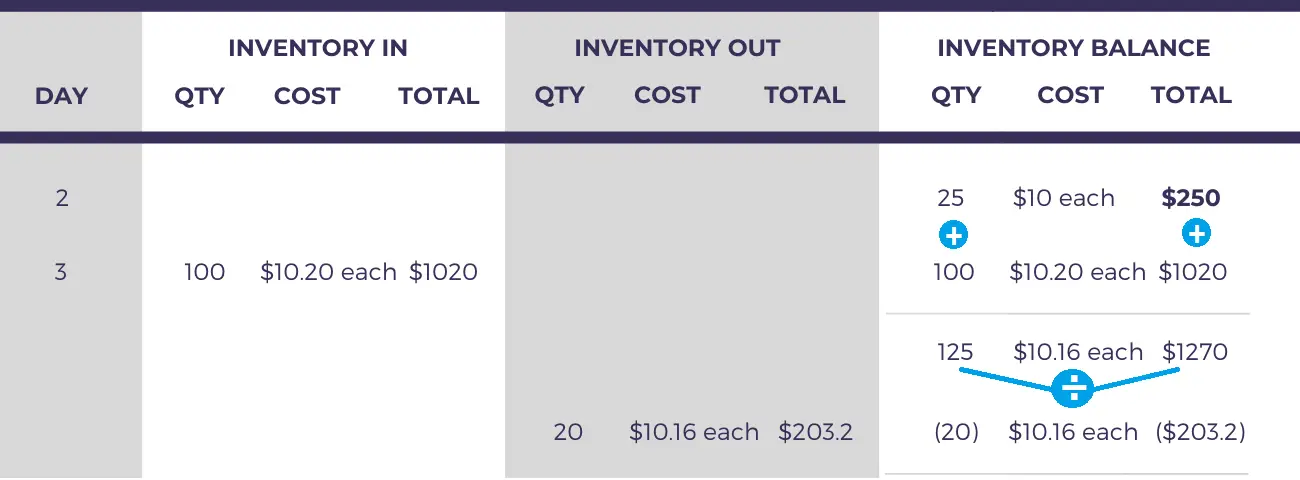

To recalculate the average cost after each addition:

- We take the opening balance before the addition.

- Add the new units and their total cost in the opening balance.

- Divide the new total cost by the new total units in inventory.

For example, on day 3, we add the units and total cost of the new purchase (100 units and $1020) to the opening balance (25 units and $250). We then divide the new total cost of $1270 ($1020 + $250) by the new total units of 125 (100 + 25) to calculate the new average cost of $10.16 ($1270 ÷ 125).

We don’t need to recalculate the average cost until another batch of inventory is added to the mix, which would alter the cost.

If the inventory is purchased and sold on the same day, it is essential to first recalculate the average cost after accounting for the additions that day before valuing the units sold.

Once the value of ending inventory is found, the steps to calculate the cost of sales and the gross profit are quite simple.

You could also calculate the cost of sales by adding up the inventory issue costs in the second column of the ending inventory calculation, which would also give the same answer.

Average Cost: Periodic Vs. Perpetual

The above example uses the perpetual method to calculate the average cost. A shorter way of finding the average cost is using the periodic method.

In the periodic average cost method, we do not calculate a new average after every addition to inventory. Instead, we estimate a single average for the entire accounting period based on the total purchase cost during that period.

The periodic average cost method does not consider the timing difference of purchases and issues during a period, which is why its value is slightly different from the perpetual method.

The periodic average cost method is a more practical alternative to the perpetual method when the inventory record is manually updated.

The following example shows how you can use the periodic average cost method to calculate ending inventory value.

Example 2 (Periodic)

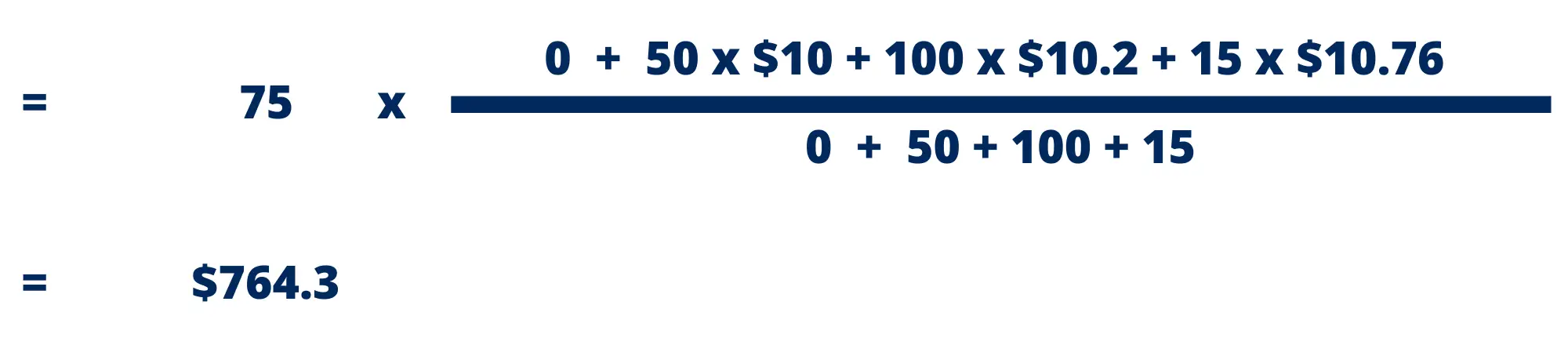

Using the first example, let’s calculate the value of ending inventory using the periodic average cost method.

To recap, we have the following data about Amy’s sales and purchases in the first week:

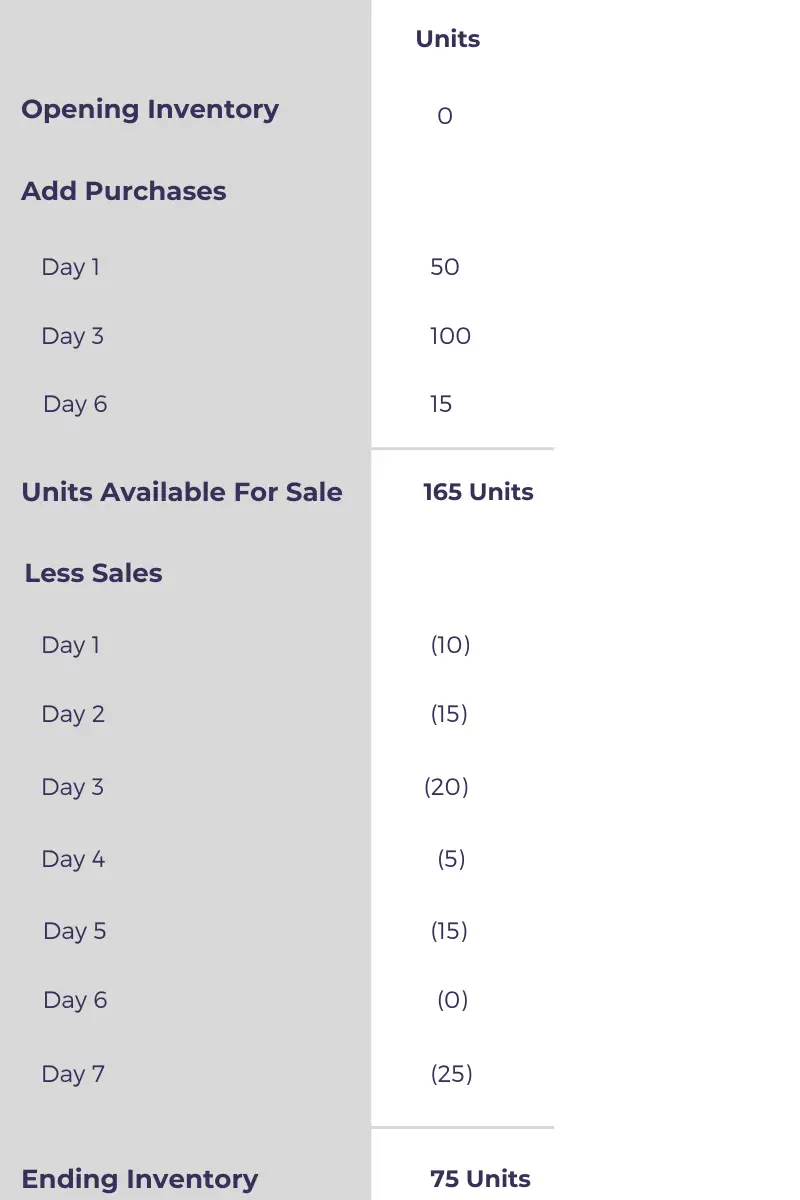

The first step in finding the ending inventory value is to calculate the units of ending inventory.

Ending inventory is the sum of opening inventory and the units purchased during the period minus inventory units sold, which is calculated as follows:

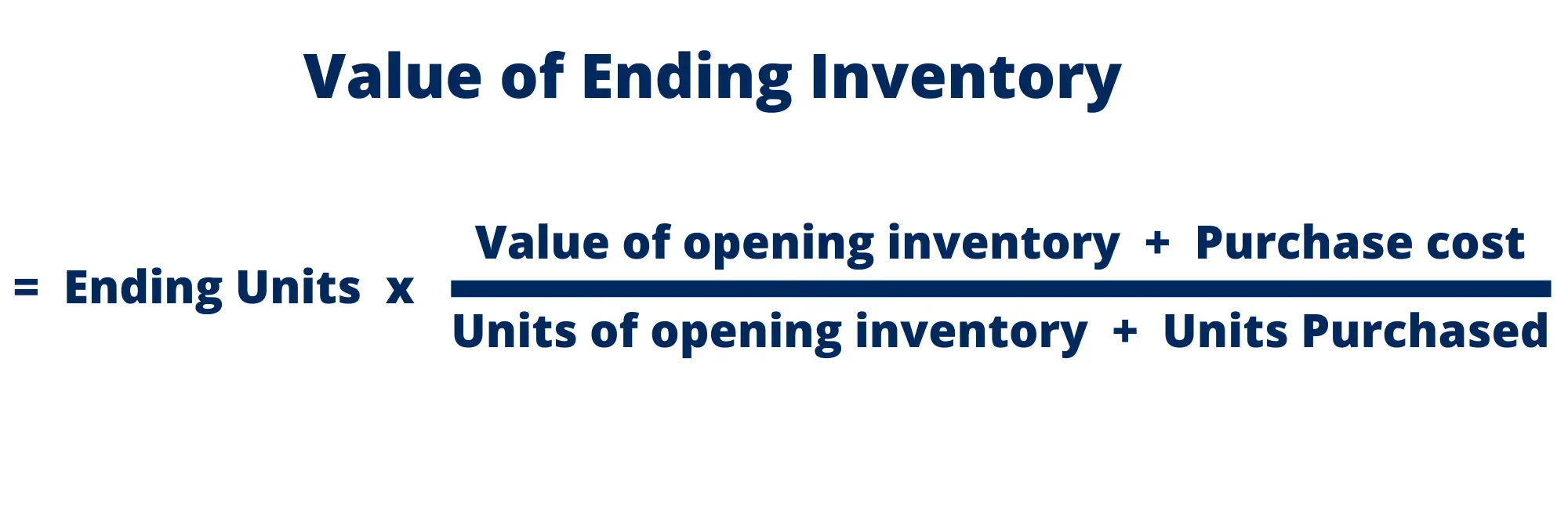

Now that we know there are 75 units of ending inventory, we can calculate the ending inventory value using the formula below.

Note that this value is slightly different from the one calculated using the perpetual average cost method.

Instructions for solving quiz:

- Click on one of the given options that you think is correct.

- If you are not sure about a question, review the lesson above.

- Mark yourself out of 4 by rewarding 1 mark for each correct answer.

Good luck!

Question 1

The average cost method values the ending inventory based on the cost of the latest purchases.

True

Incorrect.

False

Spot on!

FIFO values inventory on the latest purchase cost.

Question 2

The periodic average cost method usually calculates a different value of ending inventory compared to the perpetual method.

True

You're right!

False

Wrong answer.

Question 3

On 1 January, a shop has 10 units of a specific type of gaming device in inventory valued at $25 per unit.

On 2 January, more units costing $40 per unit are added to the inventory.

The shop sold 5 units each on 1 January, 2 January, and 3 January.

a) What is the value of ending inventory on 3 January based on the perpetual average cost method?

$375

Incorrect.

$488

Wrong.

$555

Spot on!

We need to multiply the units of ending inventory with the average cost following the last addition to find the value of ending inventory.

Ending inventory is 15 units (10 + 20 - 5 - 5 - 5).

The last purchase was made on 2 January so we need to calculate the average cost on that day.

On 2 January, the opening inventory is 5 units (10 - 5) at the cost of $25 each. The total value of opening inventory on 2 January is therefore $125 (5 x $25). If we add the purchase cost of $800 on that day (20 x $40), the total cost of inventory is $925 ($125 + $800).

Dividing the total cost with the 25 units of inventory available on that day (5 + 20), the average cost of 1 unit should equal $37.

Therefore, ending inventory is valued at $555 ($37 x 15).

$600

Incorrect.

b) If the periodic average cost method is used instead, what will be the ending inventory value on 3 January?

$375

Incorrect.

$488

Wrong answer.

$525

Correct!

There are 15 units of ending inventory on 3 January (10 + 20 - 5 - 5 - 5).

Using the formula:

Value of ending inventory is equal to:

15 x ($10x25 + $40x20) ÷ (10 + 20)

= $525

$600

Incorrect.

How many questions did you answer correctly?

Score Grade

4 Master

3 Pass