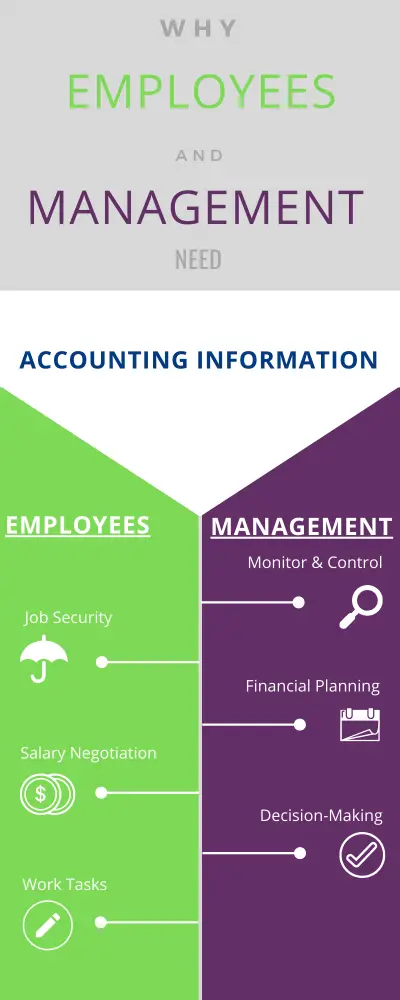

Managers and employees require accounting information of their work organization for personal and professional reasons that are summarized in the infographic below. Make sure to read the detailed explanation following the infographic.

Employees need accounting information for assessing their job security, negotiating their remuneration, as well as in the performance of work-related tasks.

Management requires regular accounting information for the effective monitoring and control of the organization’s financial matters. Managers also rely on accounting information for financial planning and decision-making.

Why Employees Need Accounting Information

Job Security

Employees are interested in knowing how well their organization is performing as it could affect their chances of remaining employed. When a business is reporting high profits and stability, its employees feel more comfortable about their career opportunities and growth within the organization.

Generally, businesses are more likely to lay off workers during times of recession to minimize their fixed costs. Naturally, people tend to avoid uncertainty and don’t want to stick around with an organization that is unlikely to survive based on their recent financial performance.

Salary Negotiation

Employers are more likely to agree to a pay raise when the business is flourishing. Employees are aware of this, which is why they are interested in the financial performance of the organizations they work for.

Some employees are especially interested in the profitability of their organizations as it has a direct impact on their income. For example, it is common for employees in startup companies to receive a share of the company profits.

Similarly, share option schemes also encourage employees to be interested in how well a business is performing as it can affect the value of their share options.

Work Tasks

Some employees require accounting information to perform tasks required by their job. For example:

- A financial accountant requires accounting data to maintain accounting records and compiling financial reports.

- A cost accountant needs information for measuring and reporting on the cost of business activities, processes, departments, divisions, products, and services.

- An internal auditor needs access to the accounting records to check if they comply with internal and external best practices.

Why Managers Need Accounting Information

Financial Planning

Financial planning involves the preparation of budgets that anticipate future income and expenses of the business. Management requires a range of accounting information to prepare budgets and forecasts.

For example, budgeting the production cost in the following year requires the knowledge of:

- What are the projected sales for next year?

- How many units of inventory from this year will carry forward to meet next year’s sales demand?

- What production constraints can limit production?

- How many units need to be manufactured in the following year?

- What is the cost of production in the current year?

- What is the proportion of production cost that is fixed?

- What is the expected rate of inflation?

Monitoring & Control

Managers need up to date accounting information to monitor and control the financial health of a business.

For an effective oversight of the financial matters, management seeks regular reporting of critical financial activities as well as any significant deviations from the financial plan.

Examples of accounting information that facilitates management oversight include:

- Monthly sales report detailing the sales revenue earned from different geographical segments, products, and services.

- Variance analysis reports that compare budgeted and actual spending.

- List of significant expenditures incurred during an accounting period.

- Product-wise and location-based profitability reports.

Decision-Making

Management relies on accounting information for decision-making.

For example, decisions to invest in a new product, or building a new production facility, or shutting down a product line, are all preceded by careful financial analysis that is grounded in accounting information.

Without reliable accounting data, management cannot accurately estimate the relevant cost and benefit of business decisions.