In accounting, it is important to differentiate between business and personal transactions because you only want to record those transactions in financial statements that relate to a particular organization. For someone new to accounting, the distinction between personal and business transactions can seem a bit confusing.

However, once you understand the concept of business entity in accounting, you will find it is quite easy to record transactions from the perspective of the business.

Business Entity Principle

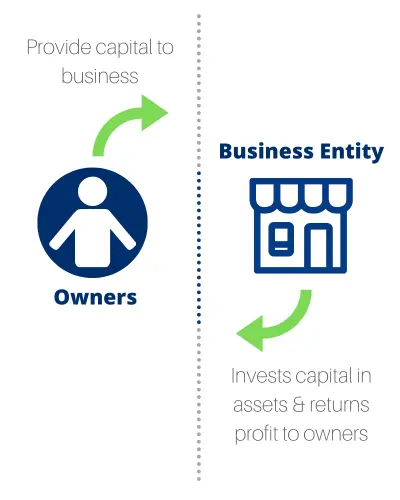

The business entity principle requires each business to be treated separately from its owners for accounting purposes. Personal activities of the owners are kept separate from the business transactions and excluded from the financial statements.

The main objective of the business entity principle is to report the financial matters of a business from the perspective of the business itself.

To apply this principle in practice, we need to think of each business as a separate entity that is distinct from its owners and other businesses.

In accounting, we consider owners as creditors of the business. We assume that the business entity borrows money from the owners and creditors to buy assets, pay for expenses, and hopefully make a profit. When there is surplus cash, the business repays the debt in the form of dividends to owners and loan repayments to creditors.

Financial statements show the assets, liabilities, income, expenses, and cash flows of the business entity. Personal information of owners, such as their assets and expenses, does not appear in the business financial statements.

The only information concerning the owners that appear in the financial statements of the business is:

- how much capital owners have contributed to the business,

- how much profit on owners’ capital has been earned, and

- how much of the profit and capital has been paid back to the owners.

In practice, the only way to ensure that the financial information of owners and their businesses do not get mixed up is to document the accounting record of each business separately.

The following examples show how to apply the business entity principle in practice. Do not forget to test your understanding by solving the free quiz at the end after going through all examples.

Example 1

Benny owns a landscaping business.

Last week, Benny paid for her home electricity bill using the business bank account. The payment was recognized as a utilities expense in the accounting records of her business. Benny thinks that because she has paid the bill through the business bank account, it can be treated as a business expense.

The payment of electricity bill is a personal cost of Benny and not a business expense. Ideally, she should not be making personal payments directly from the business bank account.

Benny should account for the payment as owner drawings rather than a business expense.

Example 2

Rambo is a fitness trainer who works from home. He trains his clients in his studio that he set up in one of the four rooms of his apartment.

The rent of the apartment is $4000 per month, which he charges as an expense in the accounting records of his business. Rambo is of the view that since he owns the entire business himself, there is no harm in charging the full rent as a business expense.

Since Rambo does not use the entire apartment for his business, he should not charge the full rent as an expense. Instead, he should charge only one-fourth of the rent ($1000) as a business expense. The remaining amount ($3000) is his personal expense that has nothing to do with his fitness training business.

Example 3

Harry runs a car rental business. Harry recently became a father to an adorable girl and decided to upgrade the family car. His old car is now parked idle back at home.

Harry has decided to put the old car to good use by using it in his car rental business. He had gotten this car as a gift from his wife.

Harry has not made any accounting entry to record this because using his personal car for business hasn’t cost him a cent.

Even though the car cost nothing to Harry, we need to assess the situation from the perspective of the business. The car is being used to generate income for the business, which is why it needs to appear in its accounting records as an asset. It should be valued at the time of its introduction to the business. The same amount will also increase Harry’s capital contributions.

Without accounting for the car, the financial statements of the business will not show the full extent of Harry’s contribution, and the assets that were used to generate the reported income. The personal cost of the car to its owner is not relevant to the accounting from the business perspective.

Quiz

How much do you know about

Business Entity Principle?

Instructions for solving the quiz:

- Click on one of the given options that you think is correct.

- If you are not sure about a question, review the lesson above.

- Mark yourself out of 10 by rewarding 1 mark for each correct answer.

Good luck!

Question 1

The business and its owners are the same for the purpose of accounting.

True

Incorrect.

False

You're right!

When it comes to accounting, the business and its owners are like apples and oranges.

Question 2

Personal transactions of owners should not be mixed with business transactions.

True

Correct!

False

Wrong answer.

Making sure that business transactions don't get mixed up with the personal transactions of owners is the key focus of the business entity concept.

Question 3

Capital contributed by the owners is a liability of the business.

True

Correct!

False

Wrong answer.

Question 4

Financial statements are prepared from the perspective of the ____________.

Business

Exactly!

Owners

Wrong answer.

Question 5

Amanda is the owner of a small shop that sells indoor plants.

While organizing the accounting record of her business, she noticed some payment receipts and tickets in her purse that were omitted from the last year’s expense total.

Can you help Amanda in deciding which of the following are business expenditures and which ones are personal payments?

Ticket to a movie that Amanda watched with her friend.

Business

Wrong answer.

It is difficult to imagine how expenditure on a movie ticket can be a business expense for Amanda.

Personal

Right!

That was a little too obvious.

Invoice of Amanda’s latest shopping spree.

Business

Incorrect.

Payment for things that are of personal use by the owner cannot be considered a business expense.

Personal

Spot on!

Ticket to a conference that Amanda visited to improve her knowledge of growing indoor plants.

Business

You're correct!

Expense on education that is necessary for self-employed owners to improve their knowledge and understanding of their trade is considered a business expense in accounting.

Personal

Incorrect.

Ticket to a circus carnival that Amanda visited.

Business

Incorrect.

Personal

You're right!

Invoice for the purchase of plants for the shop.

Business

Spot on!

Personal

Incorrect.

Invoice for a lunch with a client that was interested in hiring Amanda for the supply of indoor plants for a project.

Business

Exactly!

Personal

Incorrect.

Cost of meals served in business meetings is not a personal expense.

How many questions did you answer correctly?

Score Grade

10 Master

8+ Pro

6+ Pass

Share this Page

About the Author

Illustration provided by Icons8.